Blog 12 of the Business Strategy Series

The final area to focus on in the 8 areas that need additional strategic focus is ‘From medium term strategies to long term scenario based strategies”.

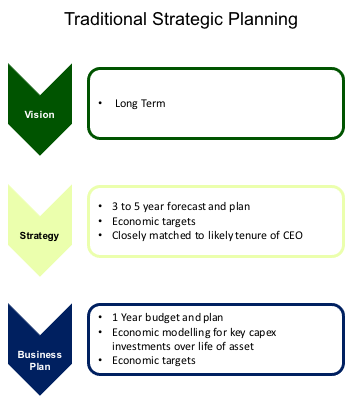

Traditional strategic planning, with some sectoral exceptions such as the energy sector, has a medium term focus (Figure 12-1). The typical time frame for a strategy tends to be in the 3 to 5 year period, closely linked to the normal tenure of a CEO and the incentive designs for the executive team.

In the Harvard Law School Forum on Corporate Governance, in a post on 12 February 2018, they refer to a recent Equilar Study regarding the tenure for CEOs at large-cap companies (S&P 500). The median tenure of CEOs sat at 5 years in 2017 with a declining trend (Figure 12-2).

With all the macro dynamics at play, this time frame for planning and incentive alignment is far too short. In the current enviroment, strategic thinking needs to be longer term focused to accommodate potential disruptions, address major shifts in products and services from new technologies and accelerated adoption and convergence of existing technologies, align with the UN Sustainable Development Goals for 2030 and address climate change.

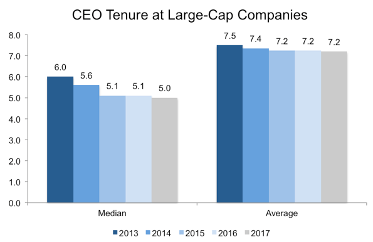

The climate change path is not yet clear as we have been slow to react, and are therefore, too early in the cycle of creating deep impactful changes; however, we are clear that we are not moving fast enough to get on a climate scenario with acceptable potential outcomes. What is clear is that the longer we delay taking action the more an extreme response will be required (Figure 12-3). With delays in strategic response to climate change, the future challenges for management will only increase.

With all these factors, only through really creating scenarios will it become strategically clear on the implications of certain decisions. In addition with climate only really playing out in about the next 30 years, it will not be until closer to 2050 that we will have clearer understanding of the potential full impact and the trajectory we are on.

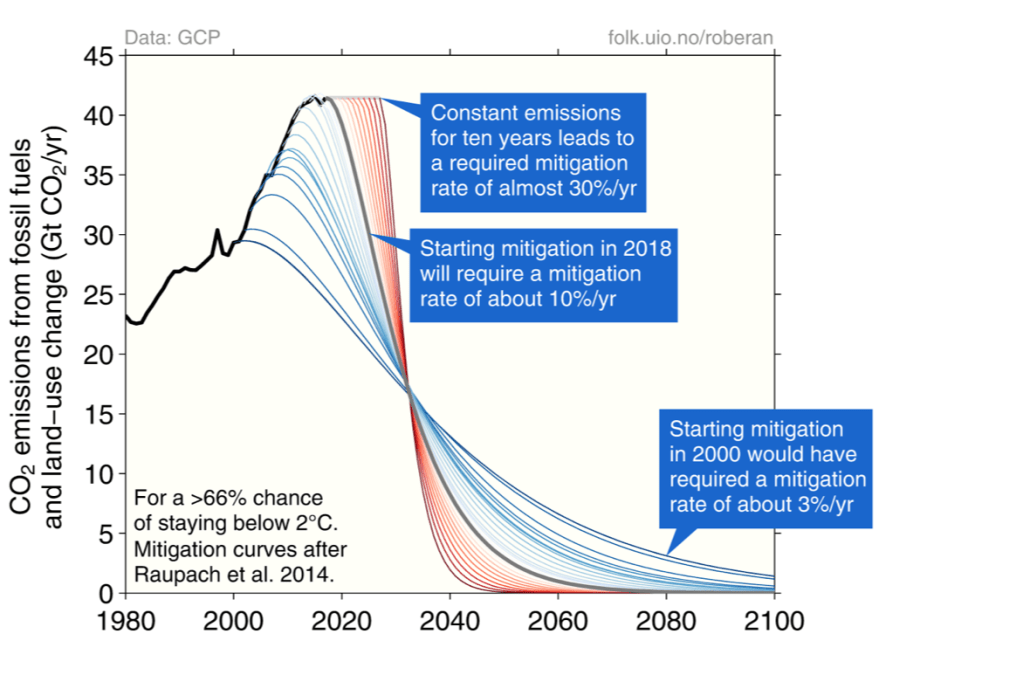

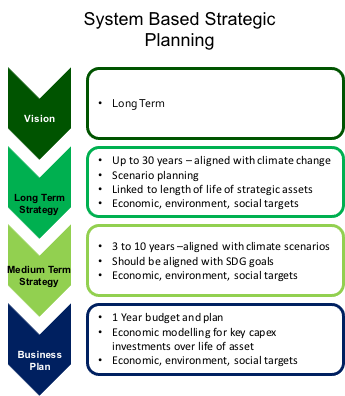

These factors shine a light on the need for changes to strategic planning horizons and the disciplined use of scenarios (Figure 12-4).

Programmes of substantial change in major components of a strategy take time, such as a shifting to a circular strategy, geographic rebalancing of assets and supply chain with increased geo-political tensions, and adjusting to major changes given the lessons learnt from Covid 19. The key is to try and understand potential key inflections points, non-linear and exponential type relationships where straight line extrapolations are invalid. These points can be driven by internal actions, fundamental shifts in markets, core changes in the role of technology, and other macro shifts and disruptions, including climate change.

In addition, to considering these points noted above is the need to reconsider the businesses view on the importance of sustainability and resilience versus a complete focus on pure efficiency with the hope that no extraneous events will interrupt this focus. Since 2008, with the financial crisis, through to the current challenges from the pandemic, we are seeing that the winners are the businesses that are most resilient. The businesses with single source or tight supply chains, high financial leverage with low rainy day capacity, or those that have been slow to embrace the power and value of technology for distributed working are requiring government handouts and/or bail out funding to survive. This is not in the interest of investors or other stakeholders including the tax paying public. Risks of disruption are increasing not slowing down, and not understanding and planning for them is irresponsible.

This analysis, thinking and understanding of the external environment and the market then needs to be married to the companies own internal analysis and understanding. The internal analysis involves the management and boards strategic view on whether they want to be a leader, a near follower or a laggard (slow follower). This view will be linked to the current situation of the business in terms of leadership, organizational capacity and capabilities, the infrastructure and technical debt of the business, the business’ innovation capabilities, the strength of their supply chain and third party relationships, and the financial capacity of the business to evolve. The meshing of internal factors, the industry and competitive environment and macro factors is what underpins the choice of scenarios and the appropriateness of planning horizons.

An interesting case history to look at is Orsted. Orsted (formerly Dong) began life in the 1970’s, as a Danish state owned energy company focus on building coal fired plants and sea bound oil and gas rigs around Europe. By 2006, they had started to build offshore wind farms and decided to focus more on green energy. They then started to close down coal plants and sell off their oil and gas sites. They now have 24 offshore wind farms with more under construction, have sold off their oil and gas sites and have committed to be coal-free by 2023. Henrik Poulsen, CEO, recently said, “we’ve transformed a Danish utility predominantly based on fossil fuels into a global leader in green energy, which was ranked as the world’s most sustainable company earlier this year. In the process, we’ve increased the market value of the company by several hundred per cent. We’re now at a point where the transformation is completed, and we’ve built a strong platform for global growth”.

Scenario planning helps understand the variability of potential outcomes under different scenarios and select the right way forward with a deep understanding of the assumptions behind the direction and the tipping points where strategic adjustments are needed. If you think of Orsted, the scenarios they would have had to explore would have had a set of critical assumptions on relative cost of energies, reliability of the energy sources, adoption rates of renewables, costs and risks of offshore windfarms, implementation risks etc. Given that they started building their offshore windfarms in 2006 wind and solar were the high cost energy sources. Projecting forward cost, capacity and quality curves on new technologies is a critical part of the scenario planning.

Different business scenarios will be required linked to different climate scenarios, and assumptions on regulatory changes, geo-political dynamics, investor behaviour with respect to the SDGs, etc. Creating clarity around critical decisions that have strategic consequences, variable financial outcomes, and different impact outcomes is critical.

Finally, Boards will have to solve how to create focus and alignment against longer term goals vs. the short term tenure and wealth creation focus of executives.

To summarise, the discussion on the eight areas requiring deeper strategic focus:

- Strategic analysis has to evolve significantly and look at a number of issues in much more depth

- Shifting from thinking about shareholders to stakeholders

- Adding macro modelling on top of industry analysis

- Extending risk monitoring with macro risks and then implementing resilience strategies and capabilities

- Building a deeper understanding of customer – product fit and the forward looking dynamics of the market

- Embedding technology, innovation, and design capabilities across the business which is critical in a rapidly changing world

- Rethinking of business models and integrating impact into business objectives

- Innovating through improving your business model

- Setting objectives around the ‘triple bottom line’

- Strategic planning to create scenarios and look at longer timeframes

- Move from short and medium term strategic planning to short, medium, and long term planning

- Build scenarios of different sector, economic, social, environmental and technological scenarios to evaluate strategic decisions

- Timeframes critically need to cover the impacts of alternative climate scenarios

In the next section, I will outline a high level system based strategic framework, with a long term view, that is much more fit for purpose than what has traditional been used for a core focus on shorter term shareholder returns.