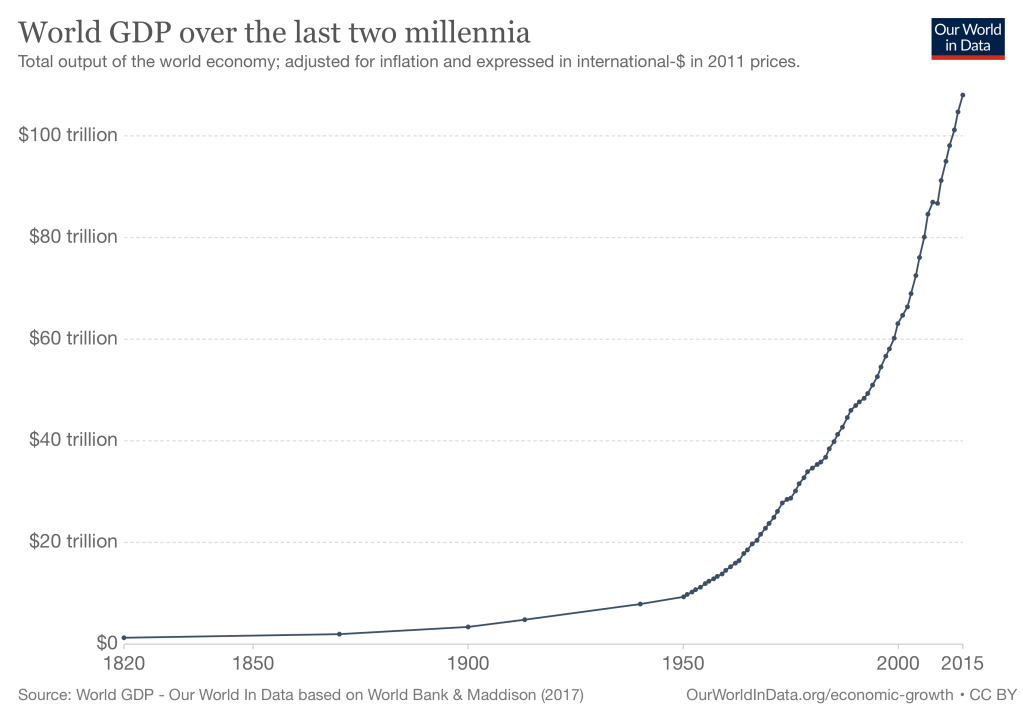

In my last blog, I tried to emphasize the importance of the role of government in society. Its legitimacy comes from the people; and, to maintain its legitimacy it has to have a clear view of the social contract it needs to deliver against. However, the governments ability to deliver against a credible social contract is underpinned by economic development and growth to drive its financial capacity to provide infrastructure and public services. The main driver of all successful economies has been the market economy and capitalism.

All the strong economies in the world are market economies. The China miracle with a market economy has created consistent high levels of economic growth. It has averaged 9.45% GDP per annum growth rate from 1978 to 2019 driven by the remarkable entrepreneurial spirit and focus on wealth creation of the people. This has been supported by a real commitment to infrastructure development and a strong focus on public services by the government.

A market economy is an economic system in which the decisions regarding investment, production and distribution are guided by the price signals created by the forces of supply and demand. The major characteristic of a market economy is the existence of factor markets that play a dominant role in the allocation of capital and factors of production. Capitalism is a concept integrated with a market economy. It is directed towards making the greatest possible profit for private people and organisations.

Creation of a market economy is one of the key initial roles of a government. There are 7 components to the framework for a market economy.

- Profit seeking companies

- Free market entry and competition

- Strong property rights and enforcement

- Absence of central planning, control and price setting

- Private ownership of most things

- Voluntary exchange

- Correction of market failures

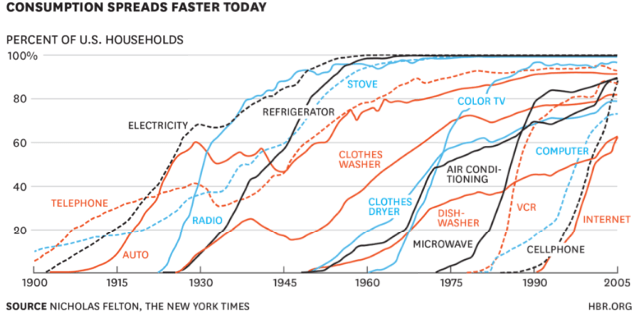

Within this framework, there are 5 factors that drive a market economy as shown in Figure 5-1. Firstly on human consumption and wants, Alfred Marshall a leading economist captured the nature of demand, in his 1890 book, Principles of Economics, “Human wants and desires are countless in number and very various in kind….. every step in his progress upwards increases the variety of his needs together with the variety in his methods of satisfying them. He desires not merely large quantities of those things he has been accustomed, but better quality of those things. He desires a greater choice of things, and things that will satisfy new wants growing up in him”

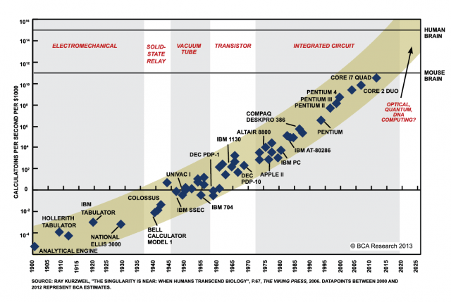

Secondly, technological progress helps address the new and growing desires of a person and where there are new opportunities with customers there are new ways to make more money or openings for new entrants. The profit making goal and opportunity is what drives this technological progress. It helps make products cheaper and better, as well as driving the innovation of new products and services. I will talk in more depth about technology and innovation in my next blog.

Thirdly, critical to underpinning the effective operation of a market economy is the efficient movement of capital to where there are opportunities to create value and provide a return to investors. There is clearly significantly more fluidity of finance to opportunities now in the 21st century. Although, the current financial system does have its weaknesses. Returns and rewards are very short term focused and the prime focus of investing and lending is cycling around the financial sector rather than investing in the productive economy. It is estimated that only about one fifth of finance in the US and UK goes into the productive economy. In the S&P 500 today approximately 90% of profits are used for share buybacks and dividends with only 10% invested back in the business. This extractive focus of finance does not help to drive economic growth.

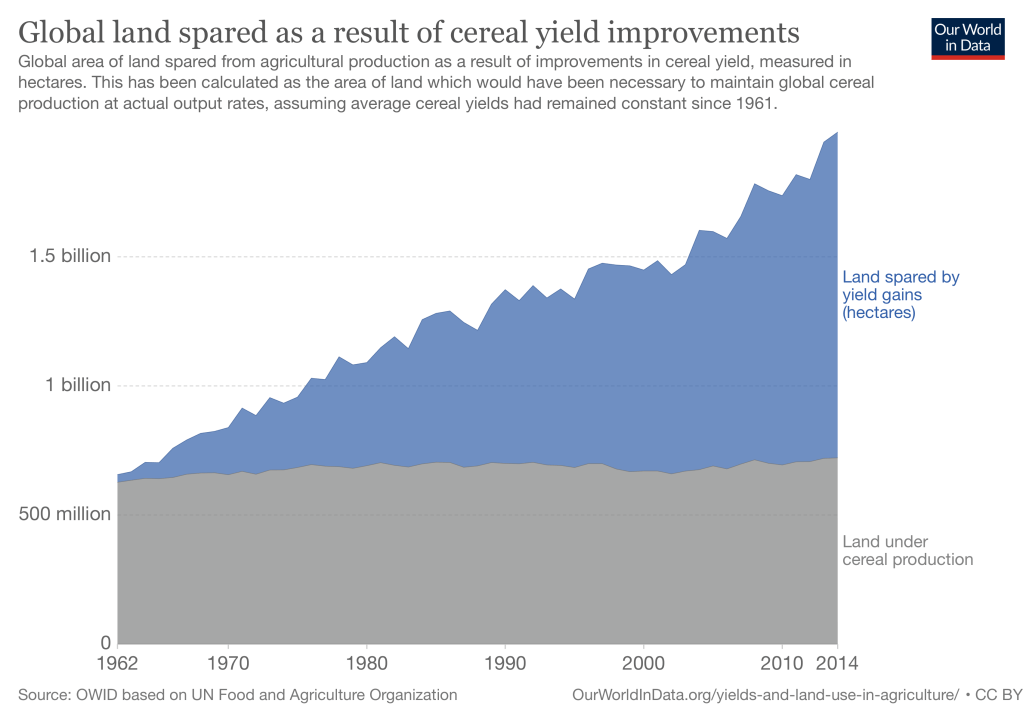

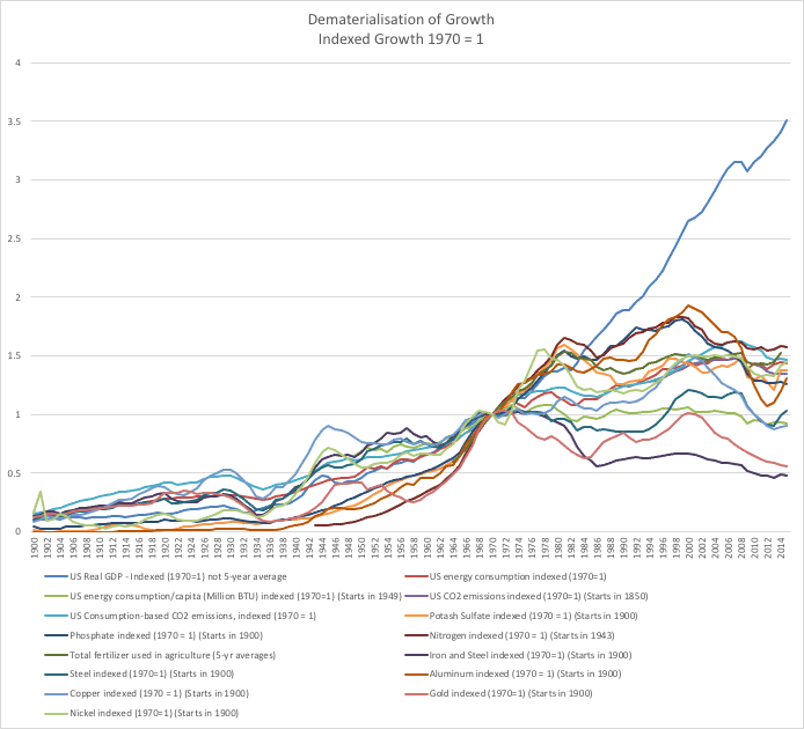

Fourthly on limits to resources, a core part of the effectiveness of a market economy is the efficient movement of factors of production towards producing the most productive goods. The prevailing theory has been that with limits to resources, market driven pricing and the profit motive, these factors help drive the efficient use and allocation of resources. Interestingly, we are now starting to move into a new phase of economic growth that is becoming decoupled from resource use.

Historically, technological progress helped to create more efficient use of resources for any good or service; however, rather than creating a reduced use of resource it resulted in additional consumption in other ways. There was a direct relationship between economic growth and resource consumption. There are now two themes emerging that affect this thinking and the conversation. The first is that we are moving into a world of abundance away from resource scarcity; and the second, is the decoupling of economic growth and resource consumption in developed markets.

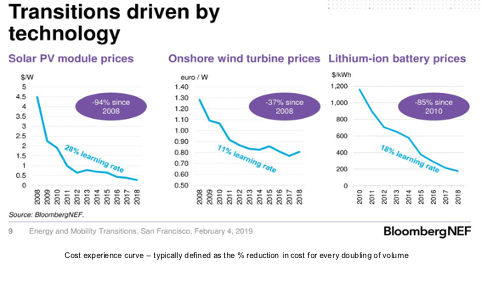

Abundance, an idea championed by Peter H. Diamandis a leading thinker on technology and innovation, is the optimistic view that technology and innovation can make rare things plentiful. He cites extensive research where through the use of new technologies costs are dropping 10 to a 1000x based on following innovation curves, such as Moore’s law in the digital space. Energy is becoming more abundant and cheaper as we move to solar and wind technologies. Safe clean water is becoming more plentiful as we are able to desalinate sea water, which is 97.5 of all water, and clean polluted water cost effectively. Food is being produced with less water, less pesticides and less fertiliser. A smart phone is now a communications device that also give you access to the worlds information, books and music. It provides medical diagnostics, it is a camera and video player, a calendar, an atlas and the list goes on. And most importantly it is moving rapidly to be available to everyone.

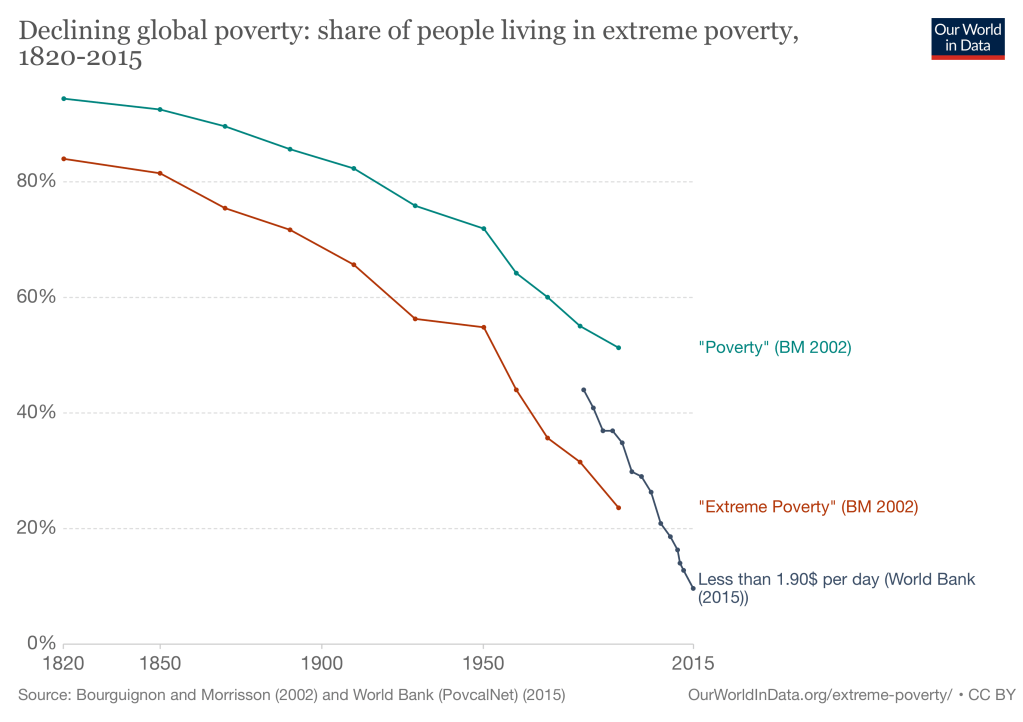

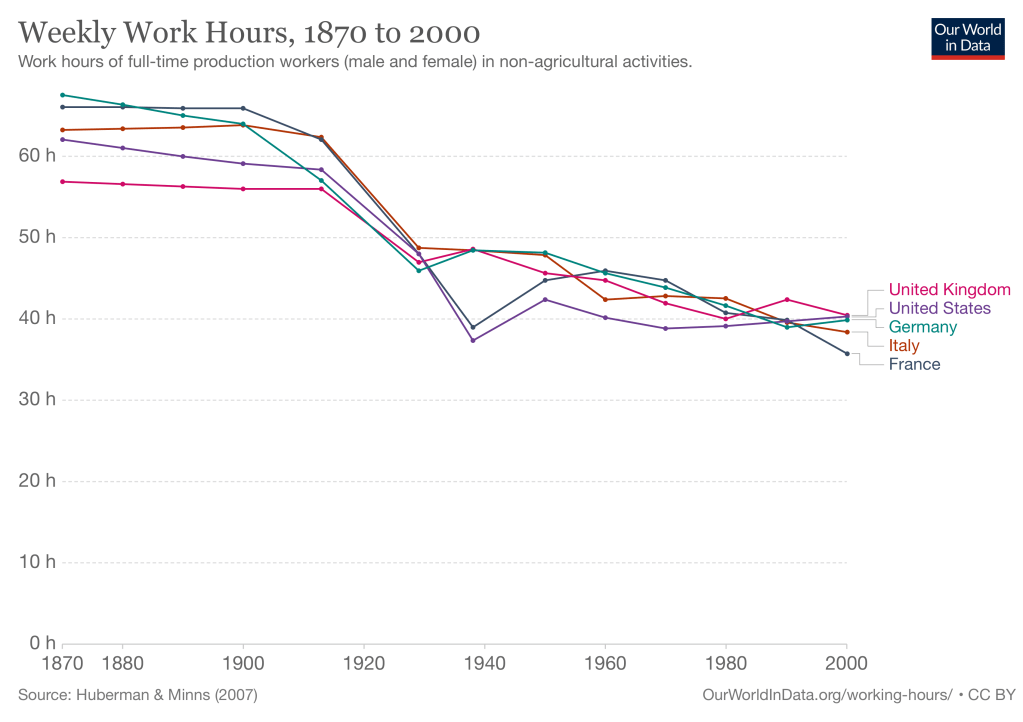

Linked to and associated with how technology is changing how we live, is the emerging net dematerialisation of economic growth. Importantly, it is the combination of technology and capitalism that is driving the continuous movement of creating new and improved goods and services to sell to as many people as possible. So many people believe the world is getting worse because our brains which are survival oriented focus on the negative things. Yet you just have to look at almost any area and the trend lines are improving (See https://ourworldindata.org which was founded by Max Roser, or research by Peter H. Diamandis).

In research conducted by Jesse Ausubel, Iddo Wernick and Paul Waggoner, they did a detailed study of the use of 100 commodities in the US from 1900 to 2010. Ausubel wrote, “…we found 36 have peaked in absolute size…Another 53 commodities have peaked relative to the size of the economy, though not yet absolutely (see Figure 5-2). Most of them now seem poised to fall”. Similar results have been found in research in the UK. This decoupling of material consumption and economic growth is also happening in energy consumption, co2 emissions, farming and water use. This is the power of technological progress and a market economy driven by a profit motive. It is worth reading “More From Less” by Andrew McAfee to learn more about this.

The combination of dematerialisation and abundance should help allay fears of the need to curb economic growth to address climate change. In fact, driving technological progress and economic growth, which go hand in hand, will be critical contributors to addressing the combination of decarbonisation and biodiversity regeneration with inclusivity and fairness globally.

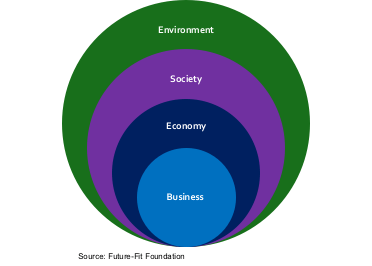

Finally, and contrary to what many people want to think, the government has an important role in the development and maintenance of a market economy. Capitalism alone is insufficient to ensure the well-being of all members and legitimacy of a society. There is a good reason that there is no example of a successful society based solely on capitalism – a model with a sole profit motive cannot stand on its own in building a society.

Material deviations in any of the first 6 components to the framework of a market economy requires the 7th component – correction of market failures by the government. The break down of free market dynamics will inevitably happen without corrections or response. Examples include competitor concentration, restrictions on market entry, use of economic power to control resources, price fixing, imbalances in supply and demand power, taking advantage of factor labour, disregarding consumer safety and security, etc. To date capitalism has not made moral and ethical judgements on what should and should not be done; governments and the law do have the responsibility for these judgements on behalf of society. Capitalism has also not been concerned with inclusivity and fairness which is a fundamental part of the provision of public goods.

It is worth noting that one key area where capitalism does not work is in sectors where there is asymmetry in information and power between the supplier and the customer. A clear example of asymmetry of power is in markets that are monopolistic in structure. Competition laws are designed to help prevent this. As important are markets where there is asymmetry in information, where the value of information is a critical component of decision making. The classic examples of this are in the pharmaceuticals market and consumer financial services. In the pharmaceuticals market, companies are able to egregiously price their drugs to take advantage of consumers who have limited medical knowledge, coupled with health fears, and limited choice because of intellectual property rights. In the financial services’ sector there are too many examples of banks being involved in mis-selling and taking advantage of the complexity of financial products and the difficulty of many consumers in understanding them. Finally, a new emerging area of asymmetry is in digital and social media sectors, where consumers are not able to comprehend the extent to which they are under surveillance and the ways in which their data is being used. This is about the cost of privacy. All sectors where the consumer is seriously disadvantaged as a result of asymmetry need attention in terms of oversight, regulation, legislation, pricing management and consideration of intellectual property rules.

The nature of government involvement in capitalism is important. Reducing the power of capitalism to create economic growth is not in societies interest. Rather it is about harnessing the power of it to drive the overall well-being of society. Governments should be concerned with red tape, and they need to think carefully about the balance of incentives they provide (carrot and stick) and the mix of regulation and legislation. Keeping government interventions as simple as possible, to achieve the desired outcome, requires continuous adjustments.

There is growing thinking that governments need to move more from reacting and responding to market based problems to shaping outcomes proactively. This shaping can be to ensure there is appropriate attention focused on topics such as climate and inequality, to helping the market drive progress in specific areas such as the shift to clean energy and electric mobility. This mission oriented approach can be seen in Denmark and UK with wind power, the US with solar and the development of electric vehicles (and previously the development of the shale energy sector), and Germany with their Energiewende program to transition to a low carbon and nuclear free economy. China has shaped multiple markets linked to their long time horizon plans ranging from the elimination of extreme poverty to being leaders in electric vehicles and wind powered electricity.

At the same time, it is often in industry’s interest to get out ahead of the government and solve problems that if not dealt with will inevitably involve government intervention. We are now starting to see this more actively especially in the areas of waste management and pollution. For example, the Alliance To End Plastic Waste is made up of nearly fifty major global companies. They have committed over $1.0 billion with the goal of investing $1.5 billion over the next five years to develop, deploy, and bring to scale solutions that will minimise and manage plastic waste, and promote post-use solutions. We are also seeing major groups of investors and asset managers driving ESG reporting and starting to allocate their investments aligned to climate and UN sustainable development goals.

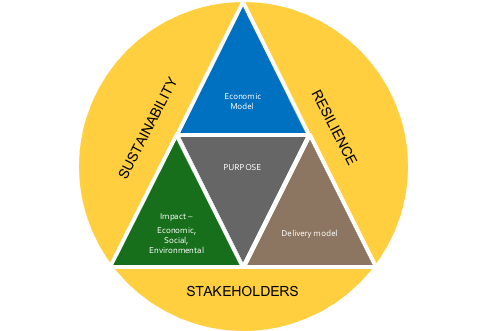

The intense focus on pure short term capitalism that has occurred from the 1980’s is starting to shift towards more aligned goals with society, such as climate and inequality, and creating what has to date been defined as ‘compassionate’ or ‘responsible’ capitalism. This will intensify as corporate behaviour is held to account by stakeholder groups and by escalating government agendas on climate, biodiversity, pollution, inequality and the societal impact of technology. It is also being driven at an accelerating rate by investors and asset managers wanting not just ESG reporting but strategies that integrate action on climate and the UN Sustainable Development Goals.

I don’t believe that there is any reason to think that a longer term focused alignment of corporate objectives with those of customers and societies cannot be as profitable as the long term profit outcomes of corporates with their current short term optimization thinking.

In my next blog, I will look more closely at the importance of technological progress and innovation.

#market economy #capitalism #dematerialisation #abundance #free markets #competition #limits to growth #technological progress #ESG #climate change #UN SDGs @Bill Gates @ Peter Diamandis #Alliance to End Plastic Waste