Blog 5 on Post Covid disruption, resilience and innovation

In earlier blogs, we have explored how this pandemic will affect consumer behaviour and how businesses and governments need to respond to build back better to create a ‘new normal’. This final blog of the series will take a macro level view of the way forward and how a coordinated response needs to come together. The Covid crisis does not sit on its own, it is surrounded and complicated by all the other pressures that need to be addressed simultaneously including employment and economic recovery, climate, inequality and geopolitical tensions.

Unfortunately, the end of the crisis is not just around the corner as Donald Trump likes to tout. We are now deep again into the Covid crisis. According to WHO as of 30 October, we are now approaching 1.2m deaths and 45m confirmed cases. Many countries are now going back into a deeper level of lockdown. This looks like we will continue with uncertainty for at least another few months, at which point we will have gone past a year of Covid. The scale of this crisis dwarfs the ‘great recession’ which started in 2008. No organisation should be passively watching what is happening; rather, the focus should be on ensuring survival and then coming out stronger for a ‘new normal’.

One of the critical things that must happen for the post-Covid period, or living with Covid period, is that all the actors necessary for a strong recovery (public, companies, government, 3rd sector) need to participate and move in the same direction. This alignment needs to also work on a multi-lateral basis.

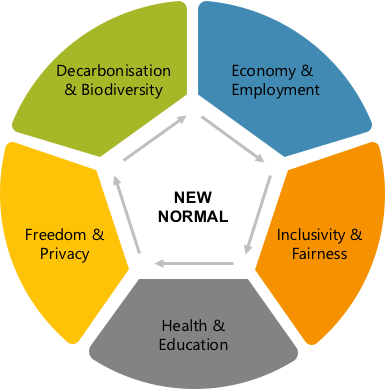

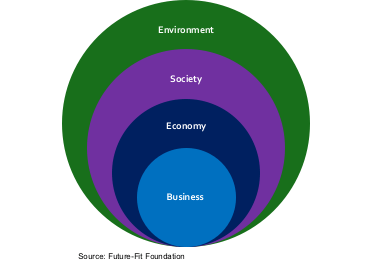

Summarising from previous blogs, at the macro level there are 5 areas where there needs to be a strong aligned response to create a ‘new normal’ (Figure 5-1).

Assuming we come out of this period either learning to live with Covid in a relatively normal way or with a massive vaccination program, the most vital area of focus will be economic and employment recovery. In the second quarter, virtually every economy had significant year on year negative growth with Spain and the UK having in excess of a 20% year on year decline. The third quarter will be better than the second quarter, but it will still be substantially down year on year. The ILO (International Labour Organization) at the end of June 2020 had a baseline global scenario of a 4.9% loss of working hours in this second half of 2020 which equates to an equivalent of 140 million jobs. This assumed no second wave of Covid! All predictions involve a massive task to restore the economy to restore employment to previous levels.

The economic damage and loss of employment have hurt the lower income sectors of all economies the most. This crisis has also more adversely affected women vs. men and the younger groups in employment. Addressing this imbalance is essential as well as dealing with all the overall issues of inequality.

What is clear from our current experience, is that there is also significant work to do in both the health and education sectors to create fit for purpose capabilities that can deal with the challenges of repeat disruptive events and move forward providing higher quality and more reliable day to day services going forward. Across all sectors of the government, especially in health and education, digital innovation or the delivery of ‘fourth industrial revolution’ capabilities are vital.

One of the large controversial areas that has significant attention in many countries is the right of governments to impinge on constitutional rights of citizens during the Covid crisis. These rights include, key rights of movement, ability to gather, rights of free speech, rights to gather and use information. There have been a number of situations in several countries, particularly in Germany, where the courts have stepped in on government interventions and defined them as overreaching, unenforceable and unconstitutional. Restoration of these rights will be a critical part of restoring social balance. There are some more insidious things that need to be dealt with that I will cover off with respect to privacy, freedom and democracy in my next blog series on ‘The individual, the market economy and the state’. There will also need to be a restoration of the rights and abilities of companies to do business without the restrictions that have been imposed on them.

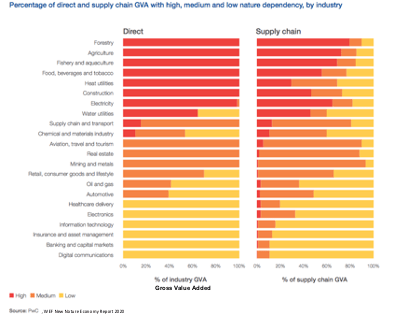

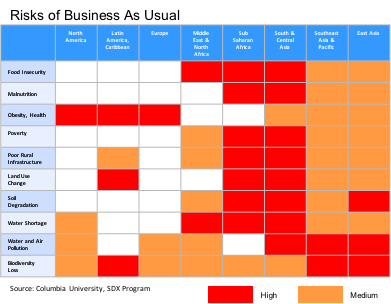

The final area and the largest looming challenge, that has not taken a break, is the urgent need to address climate warming and biodiversity. Decarbonisation and recovering biodiversity must be integrated into creating a ‘new normal’ for the living with Covid or post-Covid world.

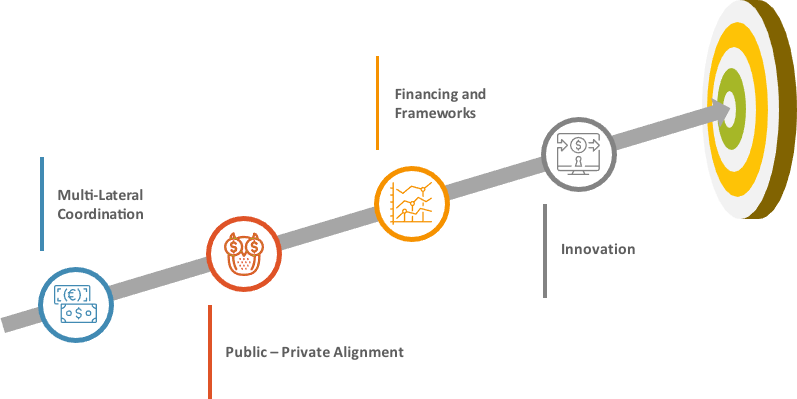

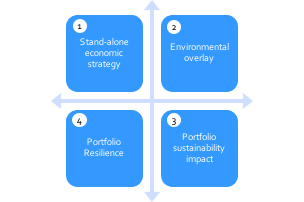

To create alignment against these factors, ideally requires 4 key components. Multi-lateral coordination, public-private alignment, financing and frameworks and a strong focus on innovation (Figure 5-2).

When I first started writing this blog at the beginning of the year, my biggest concern regarding the climate and fairness global challenges was the lack of global coordination and response to these issues. This was then exacerbated by the pandemic. Since the end of the second world war, the US has shown the leadership to help coordinate and bring together the countries necessary to address key multi-lateral challenges across the full range of issues from health challenges such as HIV/Aids and Ebola, to security and nuclear threats, to the need to address the erosion of the ozone layer. They were one of the leaders to set up the UN Nations post World War II.

Unfortunately, under the misguided leadership of Donald Trump, the US has turned inward, moved to an “America First” win-lose focus and escalated geo-political tensions. Let’s see what happens in the elections and the post-election response. The first signal will be whether or not the US finalises their withdrawal from the Paris Climate Accord which was targeted for November 4. For the sake of global progress in dealing with these urgent issues of the pandemic, climate, inequality, and the recovery of a proper democratic process in the US, let’s hope that this is the last we see of Donald Trump in the political arena!

Multi-lateral coordination is often seen primarily as coordination between countries to drive different agendas. The scope of these challenges will require responses well beyond just the political sphere. It needs the involvement of the 3rd sector including of some of the great foundations, such as the Gates Foundation which is working on some of the big issues around health, education and gender equality. And, most importantly, it needs the productive involvement of the private sector (investors and corporations) with their scale, reach, investment capacity and innovation capabilities. After all, in the advanced economies most of the wealth lies with the private sector and this investment capability must be tapped into to help solve these challenges with urgency.

Even deeper alignment of public and private sectors are required at the national level. The pandemic has seen a much higher inward focus than we have seen for decades. Local economies are inextricably linked to the health of the private sector and the support of the government, especially in these Covid times. We should also not forget that the full multiplier effect of the role and services of the government is a substantial part of any countries employment base. This inward focus, and also the self centered national response to the Covid crisis such as the control of PPE, suggests that governments and companies need to rethink their global supply chains and identify where there needs to be more local sourcing. Public-private alignment and partnerships are also required in order to have any chance of achieving progress in meeting the Paris Climate Agreement targets and to make progress against inequality.

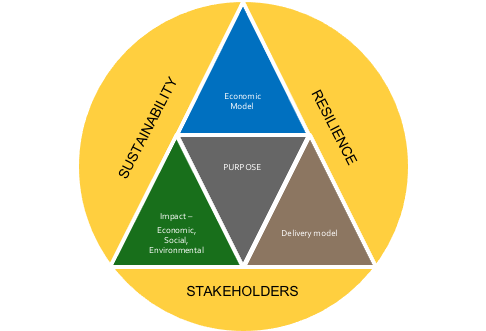

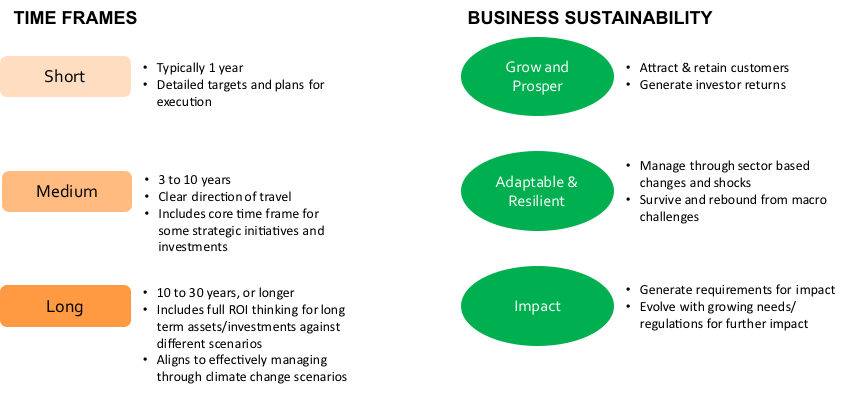

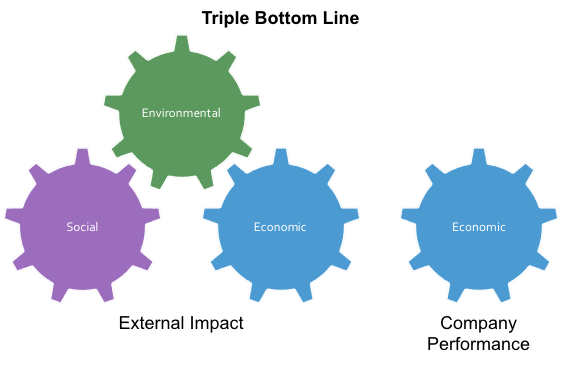

The alignment and working together of the public and private sectors requires proactive and productive involvement of the government, key leaders in business and key influential investment groups. It is in the interest of all parties to contribute to the ‘new normal’. It does mean that investors and companies have to be thinking in a longer term context and from a multi-stakeholder perspective. The good thing is that there has been a growing movement in this direction linked to climate change, inequality and the United Nations Sustainable Development Goals. The integration also requires the convening power of groups such as the World Economic Forum, who this summer initiated such an initiative called ‘The Great Reset’.

The need for financing and improving of market frameworks is substantial and of an unseen scale since the rebuilding post the second World War. This includes the recovery of employment and repositioning of economies to meet the needs of the future not the past. We have already invested over 10% of annual gdp in the advanced economies to weather the pandemic storm and substantial new rules, regulations, emergency measures have been put in place to deal with the storm. A lot more money will be required to restore economies, and there will be a need to remove the often oppressive pandemic related rules, regulations, and collection of personal information. And, even more financing and framework adjustments are needed to make sure we can prosper and de-risk our future.

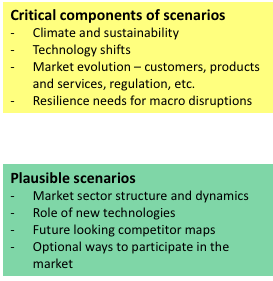

The rebooting of our way of life needs to result in a world that is inclusive, multi-stakeholder oriented, more long term focused and aligned to an environmentally sustainable world. It also need to make a step change in its preparedness for large disruptive events – pandemics, cyber, climate related. To this extent the frameworks (legislation, regulatory frameworks, reporting requirements, etc.) need to be fit for purpose and future oriented. This does not have to be more layers of rules and regulations; hopefully, it will be new frameworks replacing or updating old frameworks and not the further layering of bureaucracy.

The financing requirements of the recovery and the setting of a new normal will be vast. This is going to require the combined financing and investment power of the public and private sectors. As well as further debt financing, governments will need to look carefully at their taxation programs to not only finance the needs for public services going forward but also to ensure that the right frameworks and incentives are in place to drive private investment in the right places with the right urgency. In a number of countries, this would also involve a rethink about the focus of some of the current subsidies; such as agricultural subsidies in the US that are driving mono-crop farming in the US vs. regenerative farming.

Finally, the ‘new normal’ way of life should look and feel very different to the pre-Covid normal. The driver of achieving this is private and public innovation. This is accelerated digitisation of the economy and all its sectors including building remote and hybrid working capabilities, hybrid medical and education delivery. It needs to result in countries predominately driven by clean energy, that have heavily shifted to the electrification of mobility and have significantly changed through the use of AI, sensing and other digital capabilities. Companies need to shift to ‘circular’ strategies and innovation will help them achieve their Net Zero targets. Innovation is also needed to drive large shifts in food production and consumption and the move towards regenerative farming and rewilding. Increasing carbon sequestration on land and in the oceans is a fundamental part of dealing with climate change and biodiversity.

With the convergence of all these challenges, we are fortunate that we have never been better equipped to meet them head on. We already have the technological know how to drive massive change and new technologies and capabilities are well underway to help us complete this shift.

This is a challenging but also exciting time. As Barack Obama said in a UN General Assembly in 2016, “if you had to choose any moment in history to be born, you would choose right now. The world has never been healthier, or wealthier or better educated…” Obama then called on the audience to look with optimism to the future. “Not blind optimism, but hard-earned optimism, rooted in very real progress.”

#Covid #pandemic #WHO #UN #Donald Trump #economy and employment #inclusivity and fairness #health and education #freedom and privacy #decarbonisation and biodiversity #inequality #climate change #net zero #Barack Obama # sustainable development goals #multi-lateral #public-private # frameworks and financing #innovation