Blog 13 of the REBOOT Business Strategy Series

This is the first blog discussing a new strategic framework relevant for the world we now live in. To date, I have covered off some background on how the world is getting increasingly complex from a societal, environmental, technological and disruption perspective; and the implication of this is a need to look at business strategies from a system based perspective so that business are aligned with economic, society and environmental goals. Critically, linked to this are that the general consensus on these goals globally are best defined by the 2015 UN Sustainable Development Goals for 2030, which also link in with the 2015 Paris Climate Agreement.

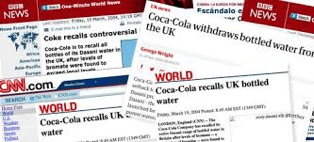

The next section then went on to cover off 8 gaps in traditional strategic thinking that need to be covered off for a strategy in the 21st century. These gaps were driven by deep interconnections of a business with their environment, which is not just their business sector. These interconnections are vital to understand as there is continuous change and ongoing disruptions that are and will be affecting a business. These factors include societal and economic factors as we can see now with the Covid 19 pandemic and ‘Black Lives Matter’ movement, the impact of new technologies, and most importantly the need to globally address the challenges of climate change and other key environmental issues.

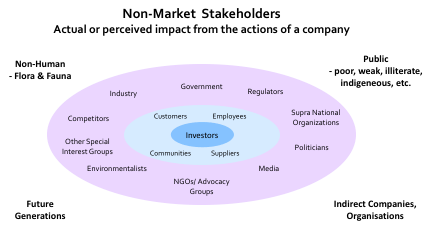

This new framework tries to create a shift in how we think about our business, away from just profitability for shareholders to goals that are also aligned other stakeholders including the public, consumers, suppliers, communities and governmental interests. It is worth noting that investors are now requiring this shift given that the long term interests of businesses are for a sustainable world and they can see real business risks on the horizon from climate change.

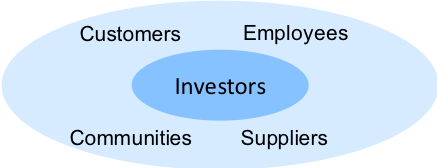

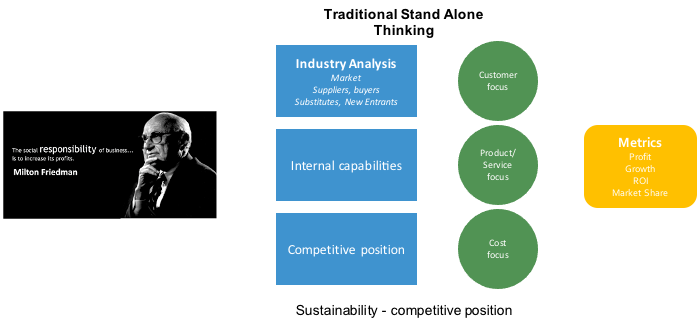

The traditional stand alone thinking (Figure 13-1) can be summarised by, firstly, a virtually exclusive focus on the shareholder as Milton Friedman had summarised,”the social responsibility of business is to increase its profits”. Secondly, an industry and competitor analysis as defined by Michael Porter’s five forces analysis matched to an understanding of the business’ internal capabilities. Thirdly, profit and market based key metrics.

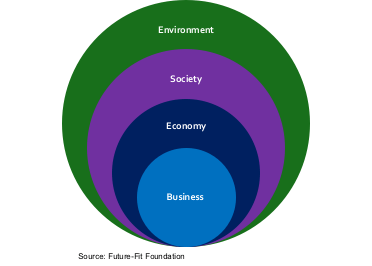

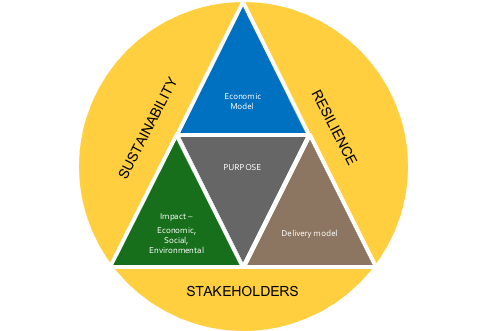

A new system based framework needs alignment from the business through to the economy, society and to the environment (Figure 13-2).

To create alignment a business needs meaningful purpose that aligns with the business on delivering against both its own economic goals as well as creating impact (Figure 13-3). This is the challenge of strategy design, to cover the needs of both profitability and impact.

Clearly, this can add complexity as the performance measures are now broader; however, it also creates opportunity and new ways of differentiating and competing. For deeply entrenched players in the market who have adverse impact on the climate/environment, they are going to have to think about how they will use their resources and market position to evolve to a new sustainable strategic position and focus. For the younger and nimbler companies, they will need to think about how to use their speed and flexibility to create a stronger positioning ahead of their key competitors. If you are already there, then take advantage of your position.

A key part of this system-based framework is that it is relevant for all types of organisations whether in business, government or as an NGO. Clearly, each type of organisation, as with each business, has to be clear on their economic model and what their impact targets are in order to get clear on what delivery model they need. In the government and with NGO’s, they will have very different sources of funds; but, in any event they need to solve a sustainable financial model to survive rather than to make a profit. A governments whole raison d’être should be impact; although, for many of us it may well be that their targets and metrics of achievement are unclear!

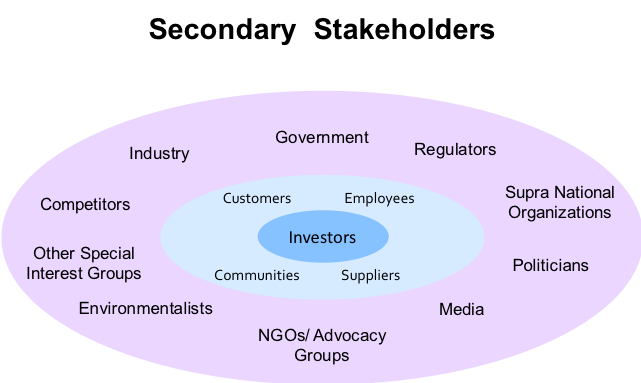

Surrounding these triangles are three components that need to be full addressed within a strategy (Figure 13-4). Firstly, having a clear view of the key stakeholders of the business. Secondly, the business must be built to last – it must be sustainable. This means the business must be able to continuously deliver value to it customers, it must deliver the right economic performance for investors, and it must provide the appropriate impact for other stakeholders. And, the business must be able to adjust, adapt and move forward in a way that this continues over time.

Thirdly, the business must be resilient and thus have the capability to withstand and manage through different scenarios of disruption from the 5 types of macro forces – societal, environmental, economic, technological, and geo-political – to the core challenges specific to the

Figure 13-4

There are six tests of a business strategy:

- Is the business Purpose Driven?

- Can the business create real differentiated value for its target customers over time?

- Can the business perform at a level to attract and retain investors?

- Does the strategy integrate generating economic, social and environmental impact at ambitious levels for key stakeholders?

- Does the business strategy create sustainability and resilience?

- Does the strategy have ambitious and achievable triple bottom line metrics covering profit and impact targets?

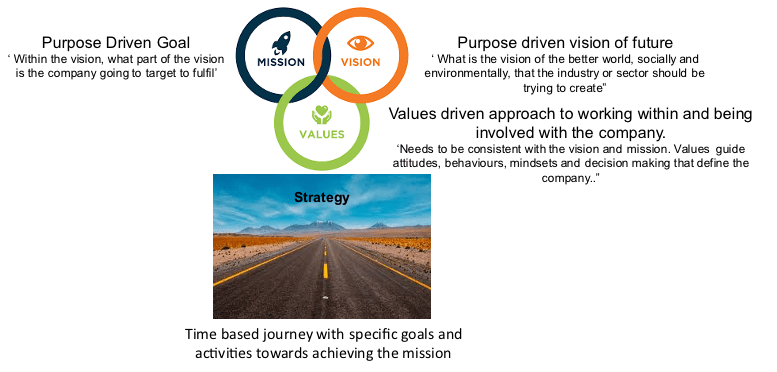

At the heart of a business lies its purpose. It is the driving force and acid test of all business decisions. It is what attracts and retains employees, customers, other participants in the supply chain and investors. Sitting above the strategy are three components Vision, Mission and Values. There are a lot of different views about how to define vision and mission, and sometimes they are combined; so to clarify, I have created definitions that fit with this strategic framework.

Within this strategic framework, the purpose defines how the world will be a better place as a result of the business. The first component of the purpose is the Vision. The Vision is the business’ view of the better world that the industry or sector will contribute to. The Mission is the part of the vision that the company is targeting to fulfil. I like to describe the Mission as the North Star that the company wants to be continuously moving towards. Finally, the Values defines behaviourally how the Company‘s operates – what drives it, what motivates it, and how it will behave with its employees, customers, suppliers, communities, society and environment. The combination of the vision and mission should be something that engages, and gains agreement from, all key stakeholders.

Here are some examples of the vision and mission, or a combined statement, for purpose driven companies.

Orsted

Our vision is a world that runs entirely on green energy.

Mission: “We want to be a company that provides real, tangible solutions to one of the worlds most difficult and urgent problems.”

This is a Danish Company that started life as a state owned organisation focused on coal and oil. Most recently it has been recognised as ….

Within this strategic framework, the purpose defines how the world will be a better place as a result of the business. The first component of the purpose is the Vision. The Vision is the business’ view of the better world that the industry or sector will contribute to. The Mission is the part of the vision that the company is targeting to fulfil. I like to describe the Mission as the North Star that the company wants to be continuously moving towards. Finally, the Values defines behaviourally how the Company‘s operates – what drives it, what motivates it, and how it will behave with its employees, customers, suppliers, communities, society and environment. The combination of the vision and mission should be something that engages, and gains agreement from, all key stakeholders.

Here are some examples of the vision and mission, or a combined statement, for purpose driven companies.

Orsted

Vision: “Let’s create a world that runs entirely on green energy.“

This is a Danish Company that started life as a state owned organisation focused on coal and oil. Their current primary focus is on offshore and on shore wind farms. Most recently it has been recognised as the most sustainable company in the world in the Corporate Knights 2020 Global 100 Index.

Novo Nordisk

“Our purpose is to drive change to defeat diabetes and other serious chronic diseases such as obesity and rare blood and endocrine disorders. We do so by pioneering scientific breakthroughs, expanding access to our medicines and working to prevent and ultimately cure disease.“

How many other pharmaceutical companies have a missions to ultimately cure diseases where it derives all its revenues from?

Unilever

Vision – “to make sustainable living commonplace.”

Mission – “To add vitality to life. We meet everyday needs for nutrition, hygiene and personal care with brands that help people feel good, look good and get more out of life.”

Tesla

Mission: “To accelerate the world’s transition to sustainable energy“

We all know Tesla for it’s pure electric vehicles; however, it now has a full suite of energy products that incorporate solar, storage and grid services.

Ikea

Vision: “To create a better everday life for the many people”

“Our business idea supports this vision by offering a wide range of well-designed, functional home furnishings products at prices so low that as many people as possible will be able to afford them.”

Microsoft

Mission: “To empower every person and every organization on the planet to achieve more”

“Our platforms and tools make small businesses more productive, multi-nationals more competitive, nonprofits more effective and governments more efficient. They improve healthcare and education outcomes, amplify human ingenuity, and allow people everywhere to reach higher.”

Patagonia, an outdoor clothing company, has had a sustainable mission since the beginning and has self imposed an earth tax of 1% of revenues for support activities to save the planet. It has a very broad mission, “we’re in business to save our home planet”

It has defined it values in a different way to most companies that state the obvious ones of honesty, integrity, etc. Their values are more action oriented, very honest, and I think much more engaging:

“Build the best product – Our criteria for the best product rests on function, repairability, and, foremost, durability. Among the most direct ways we can limit ecological impacts is with goods that last for generations or can be recycled so the materials in them remain in use. Making the best product matters for saving the planet.

“Cause no unnecessary harm – We know that our business activity—from lighting stores to dyeing shirts—is part of the problem. We work steadily to change our business practices and share what we’ve learned. But we recognize that this is not enough. We seek not only to do less harm, but more good.

Use business to protect nature – The challenges we face as a society require leadership. Once we identify a problem, we act. We embrace risk and act to protect and restore the stability, integrity and beauty of the web of life.

Not bound by convention – Our success—and much of the fun—lies in developing new ways to do things.”

With a broader awakening of Boards and executive teams, as well as investor pressure, we should expect an increasingly rapid shift to much more purpose driven vision, mission and values? The companies not moving in this direction will inevitably be left behind.

The overall strategic framework tries to achieve 3 core objectives. Firstly, to ensure the business is systemically integrated into its economic, social and environmental situation context. Secondly, provide absolute clarity that the business is also focused on impact as well as profit to meet the needs of all key stakeholders. Finally, to have a true longer term perspective that considers both resilience and sustainability.

In the next two blogs, I will fill out the other components of the framework.