Blog 3 of Business Strategy Series

Now let’s talk about factors that affect our current global environment other than Covid 19.

Businesses sit within a complex ecosystem. As long as all the factors in that ecosystem are relatively stable then running a business can be relatively straightforward, and if you have been able to build a strong competitive position then you have a good chance of maintaining your position. However, once the number of dynamics affecting your business start growing the challenge can become exponentially more complex.

These dynamics can come in many forms and from many sources, ranging from the development of new or existing technologies, to gradual changes in regulations, to activities that require a rapid response from events such as a pandemic, floods and fires, or a financial crash as in 2008. To make it even worse a number of these dynamics could be happening simultaneously within a short geographic time frame. Just in the last 9 months, we have had the severe fires that affected California and Australia, and now we have rolled into the Covid 19 pandemic that has also caused a financial crisis, a massive disruption to how we work, and there has been an oil price shock. This is without looking in more detail into many countries where there will be whole sets of other ripple effects; such as, social instability being driven by lock down in low and middle income economies.

If you just look at the World Economic Forum 2020 Interconnections map below on macro risk factors, it is pretty clear that businesses will have to be continuously managing in an uncertain environment and they will need the flexibility and adaptability to deal with a broad set of challenges.

These events can require quick responses such as from cyber attacks/data fraud and the current pandemic, to medium term responses from factors such as changing trade relations, as is happening currently between US and China or with Brexit, to fundamental changes required for example in response to climate change.

Another way to think about this is to look at what types of events can cause economic disruptions or create tipping points. From this perspective, I am thinking of a tipping point as an event or set of events that drive a fundamental change in performance and/or require a material change in how you manage your business. A historic straight line extrapolation of performance as an assumption of how to drive key decisions in a business can only looked at as an assumption of hope over reality. Maybe you will get lucky!

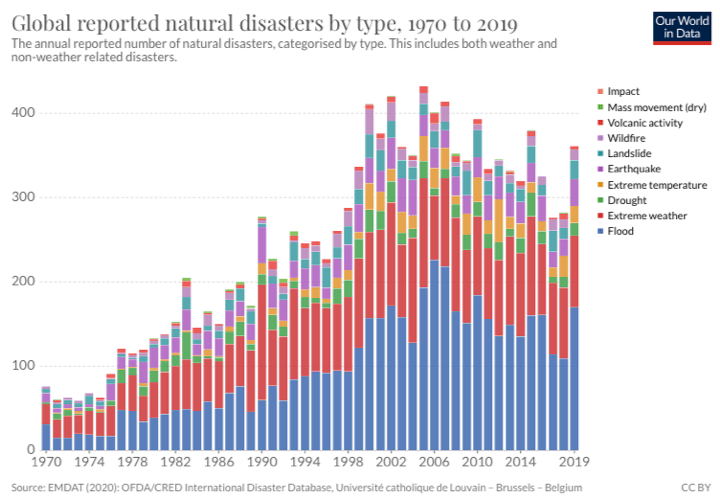

These disruptions can come in many forms including those that are natural, man-made or health based. As you can see from the graph below (Figure 3) on globally reported natural disasters, we are now in the range of 300 to 400 natural disasters per year vs under 100 in the 1970’s.

It is worth noting that most of these events are weather related. The extensive science on climate change suggests that the frequency and scale of these weather related disruptions will only increase as the planet is warming. It could also be argued that the economic disruption per event will also be increasing over time as the world is getting smaller from globalisation. For example, our food supply chains reach to all parts of the world and material sourcing for our manufacturing comes from many parts of the world. So a local natural disaster can disrupt businesses all over the world.

There are also multiple sources of potential man-made disruptions as noted in Figure4.

Not all disruptions are problems; although, with the wrong leadership they will be. An oil spill maybe a problem for one company or an opportunity for another; or, low cost solar energy maybe be a problem for an oil company and an opportunity for clean energy focused companies. In the digital space, there can be major disruptions from cyber attacks and ransomware, on the opportunity side a whole industry has arisen to help companies deal with these issues.

In 2007/2008 there was a convergence of a set of technologies/digital capabilities that would dramatically change how consumers would run their lives and how we could manage a business. This was a tipping point. The convergence included the ability to use computing power against big data, the emergence of cloud computing, the relatively ubiquitous availability of broadband, the launch of the first Apple smart phone and the large scaling of social media usage started by Facebook (only 58 million facebook users in December 2007). Many companies have changed how they operate as a result of these combinations of technology and many new companies have emerged that are threatening older companies.

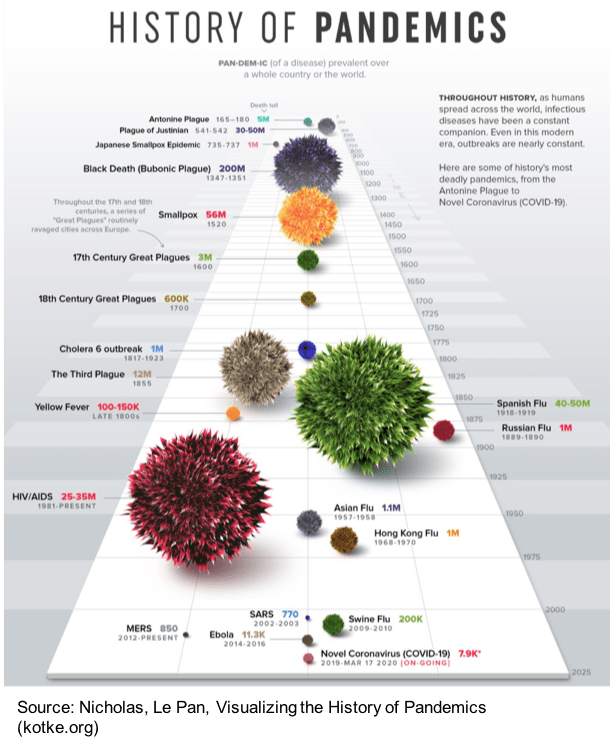

In health, this is not the first pandemic we have seen and will not be the last. As of 2 June 2022, we are closing in on 400,000 deaths from Covid 19 and we are still in the first wave.

We all know this has also had serious consequences for our economies, how we socialise and our international mobility. We have no idea how long this will economically affect different sectors and how it will shift consumer and purchasing behaviour both temporarily and permanently.

So in our environment, we can see an increasing frequency and scale of disruption, some of which are truly just temporary challenges and others that will question the strategy, structure and key operating assumptions about how a business operates. These disruptions may come as complete surprises, become visible with some element of time to respond or have a long term fuse but still need urgent attention, such as climate change. They will also have different characteristics in terms of being solveable to requiring a fundamental change in the business model of companies that it is affecting. The question for a business is are you going to deal with these disruptions as and when they occur, are you going to be prepared for certain disruptions and be able to rapidly respond to minimise the cost, or are you going to anticipate some happening and be ready to take advantage of them. Recognizing that certain disruptions are really also tipping points and being able to react faster than others should be seen as a source of competitive advantage and a way to outperform in the marketplace.

In my view, business should consider ongoing disruptions as the ‘new normal’ business environment rather than stability as the normal situation. The potential benefits of resilience in a disruptive world may well be a better strategy than a tight manufacturing and supply chain that will be more efficient in a steady state world. More on this as we talk about risk and resilience in later blogs.