We have now covered the first six of the eight topics for strategic focus. As a reminder, the eight topics are:

- From shareholders to stakeholders

- From Michael Porter’s five forces to macro models

- From risk monitoring to business resilience

- From product-market fit to customer–product fit

- From simple to multi-factor business models

- From product to company based technology, innovation and design

- From profit focus to triple bottom line

- From medium term strategies to long term scenario based strategies

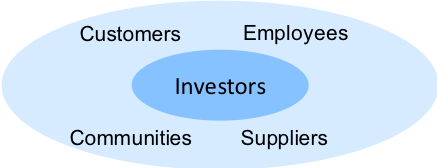

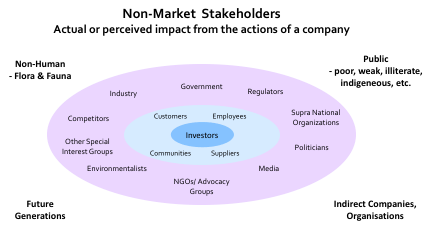

The seventh topic, from profit focus to triple bottom line, is a major shift for most companies from being shareholder focused to stakeholder focused. This shift in the purpose of the business requires new thinking, different leadership and major adjustments to incentive systems to create alignment. Simply put, a company must now extend their objectives beyond measurements almost exclusively focused on shareholders to also add measurements on environmental, social and economic impact.

Let’s start by looking at the pressures to move beyond a pure profit focus. These pressures are from nations, central banks, investors, consumers and the public as illustrated by Figure 11-1.

In 2015, the UN reached agreement, with all United Nations Member States, on 17 Sustainable Development Goals and 169 targets focused on economic, social and environmental goals for 2030. 193 countries are signed up to this agreement.

Also in 2015, the Paris Climate agreement was signed. The Paris Agreement sets out a global framework to avoid dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it to 1.5°C. It also aims to strengthen countries’ ability to deal with the impacts of climate change and support them in their efforts. There are now 197 countries signed up to this agreement. Shockingly, the US under Donald Trump said that it was going to withdraw from the agreement and the effective date is 4 November 2020, 1 day after the next presidential election. You can imagine who the rest of the world is voting for!

As of June 2020, twenty countries and regions have agreed net-zero targets by 2050 – Austria, Bhutan, Costa Rica, Denmark, the European Union, Fiji, Finland, France, Hungary, Iceland, Japan, the Marshall Islands, New Zealand, Norway, Portugal, Singapore, Slovenia, Sweden, Switzerland and the United Kingdom. Denmark is leading the way and has legislated a target of reaching a carbon emissions target 70% below its 1990 levels by 2030.

About 50 central banks have now joined the NGFS, the central banks’ network focused on climate change risk management. . Mark Carney, former Governor of the Bank of England, has been one of the global leaders in pushing forward this climate agenda. The Bank of England will be the first central bank to test how well the financial system can withstand risks posed by climate change. Under this test the largest lenders, insurers and asset managers will have to stress test their portfolios against different climate scenarios. In turn, they will need to engage the companies behind these loans, insurance policies and investments to provide information for this reporting. The Federal Reserve has declined to participate; but, it is realising that this position will not be tenable for much longer (FT.com 120120, Gavyn Davies).

Investors representing about $130tn in investments are now starting to require ESG (Environmental, Social, Governance) reporting. Some of these portfolio managers have also set climate targets for their portfolios as part of their criteria for investment. Two of these funds are the Norwegian and Japanese Soveriegn Wealth Funds, each of which have fund valuations well in excess of $1 trillion.

There is also a group of over 450 investors, Climate 100+, who represent $40tn in investment that are initially focused on 161 global companies that cover up to 80% of global industrial emissions with 3 goals. Firstly, to improve corporate climate governance, secondly to curb emissions in line with the Paris Agreement and finally to strengthen climate related disclosure.

Shifts in investment focus and willingness to lend money to certain sectors is already underway. One of the first sectors to be hit hard has been the coal industry. Investors are looking more intensively at the ESG focus of companies and adjusting their decision making on investments. Banks are under increasing pressure to do responsible lending and are also starting to restrict their focus towards companies that are impact focused; although, there is still a long way to go.

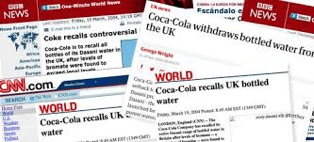

The fourth group of stakeholders are customers who are increasingly voting with their wallets on social and environmentally responsible companies. This involves shifting their purchasing from companies who breach fair trade principles, are not diversity inclusive, support Amazon deforestation, are high CO2 emitters, and are plastic and types of polluters.

Finally, there is the public that are showing that they want things to change whether it is climate protests all over the world linked to Greta Thunberg, who has twice been nominated for the Nobel Peace Prize, or the response to the recent ‘black lives matter’ protests. Both of these are driving significant rethinking in Board rooms regarding environment and social responsibility.

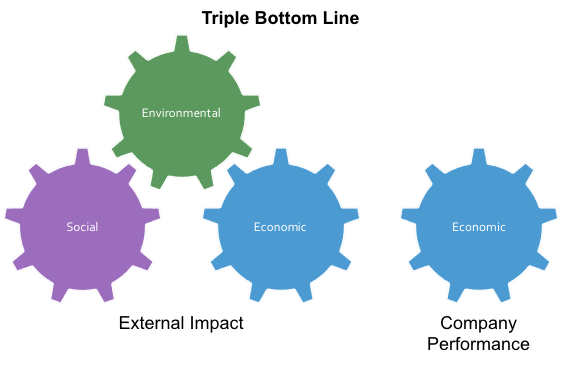

The memorable way to capture this approach is to use the phrase John Elkington coined over 25 years ago, the ‘triple bottom line’ (TBL) or as it is also named ‘people, planet, profit’. The idea is that as well as profitability of the company there needs to be impact measurements linked to sustainability.

The use of this phrase has gone in different directions, so I will define it specifically as to how I am thinking about it. Given the need to integrate with the UN SDGs (Sustainable Development Goals), which is the best current consensus on the set of components required for long term sustainability of the planet, there are three areas of external impact that need attention – economic, social and environmental impact. Clearly, also for the company to be sustainable it must focus on its profitability and growth in order to attract and retain capital. In this context then the company has two factors in the economic component (Figure 11-2). Firstly, its own economic performance; and secondly, its external economic impact at the local, national and international levels.

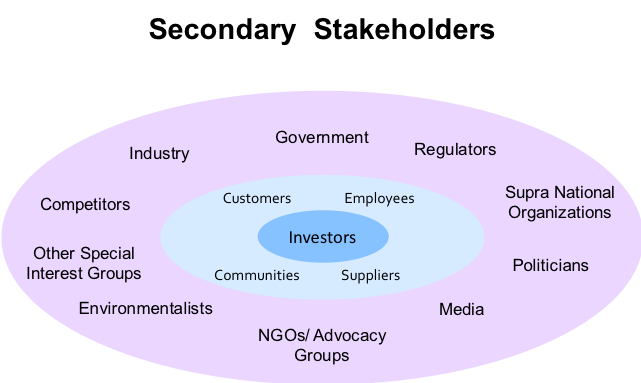

Companies now need to both align their Triple Bottom Line strategies with their key stakeholders as well as building the reporting and measurement requirements for internal use, for ESG reporting and for the needs of investor rating agencies.

These are the impact definitions that need to be considered to establish the impact measurements the company chooses to focus on.

- Economic: the positive and negative impact an organization has on the local, national and international economy. This includes creating employment, generating innovation, paying taxes, wealth creation and any other economic impact an organization has.

- Social: the positive and negative impact an organization has on its most important stakeholders. These include employees, families, customers, suppliers, communities, and any other person influencing or being affected by the organization.

- Environmental: the positive and negative impact an organization has on its natural environment. This includes reducing its carbon footprint, usage of natural resources, toxic materials and so on, but also the active removal of waste, reforestation and restoration of natural harm done.

There is confusion on how a company should define its own situation specific impact factors. Clearly, this is going to be affected by sector and geography as well as the specific strategy of the company, and how impact ties into the value proposition to its customers and other key stakeholders. The concern is that companies must focus on ambitious impact targets aligned to ambitious profitability targets. With the fuse on climate change and other critical environmental issues burning, just reporting on ESG without a deep understanding, thinking and commitment to a strategy with impact will fall far short of what is required and ultimately expected by key stakeholders.

Setting impact factors can start with understanding the current impact of a company; however, it does not stop with just setting tighter targets within the existing strategy that require moderate changes to achieve. From an environmental perspective, if you are depleting resources, are an energy producer, have high energy consumption, are a manufacturer or you have high volumes of waste (eg. packaging) then a major rethink of your strategy is probably needed to ambitiously reduce your environmental footprint and reposition yourself. The broad goal would be to shift from a linear strategy of ‘take-make-waste’ towards a wasteless or circular strategy. One of the leaders in this space who are helping drive this shift is the Ellen MacArthur Foundation (www.ellenmacarthurfoundation.org ).

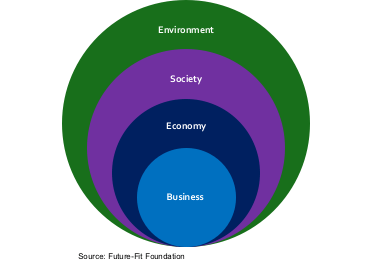

The core elements of a circular strategy, to create a circular economy, is to firstly design out waste and pollution. Secondly, to keep products and materials in use and finally to regenerate natural systems. From an economic and social impact view, the goal is very much about responsible management towards employees, customers, other players in the supply chain and related communities. Considerations include anti-slavery, fair trade and work practices, providing living wages, the provision of health services, education/skills development, paying taxes (eg. not working through tax havens), and enhancing and supporting the key communities that interact with the business. Decisions on the impact focus, as well as profitability, also need to be tied into resilience considerations. A strong and sustainable strategy will create alignment of the business with the economy, society and environment (Figure 11-3).

In summary, businesses need to shift their thinking to focus on both profitability and impact. Impact factors are defined by the UN SDGs. The specific impact targets that a business sets as its goals will be affected by the industry sector, the businesses geography and the particular strategy of the business. Businesses need to revisit their strategies and in many cases make some fundamental changes in order to set ambitious impact targets along with their profitability ambitions.