Blog 8 of the Business Strategy Series

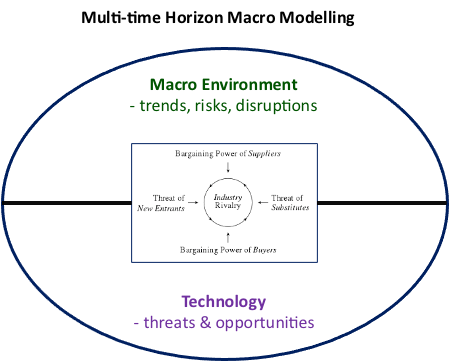

To date I have addressed 3 of the strategic topics that are integral to strategic thinking going forward. The topics have been ‘from shareholders to stakeholders’, ‘from Michael Porter’s five forces to macro models, and ‘from risk monitoring to business resilience’. In this blog, I will cover ‘from product – market fit to customer – product fit’.

A more detailed understanding than product market fit is required in assessing the full opportunity for a business. Marc Andreessen, co-founder of influential Silicon Valley venture capital firm Andreessen Horowitz, coined the term product-market fit in a 2007 blog post, defining it as “being in a good market with a product that can satisfy that market.” Traditionally this has been from primarily looking at the existing market. In the venture capital world, this usually involves market testing to confirm that an exciting market opportunity exists which is the right place to start. Unsurprisingly, with existing businesses this examination of an existing market is also done but often with not enough rigour on looking at the future.

Customer – product fit is the matching of a product or service proposition with the needs of a large, and ideally growing, set of customers that will underpin a thriving business over time.. The reason that I choose to call it customer – product fit is that the critical thing is that only by truly understanding the customer will you match a need with the right product fit. In addition, in an established business having a proper detailed understanding of market dynamics, opportunities and how they will evolve is mission critical to investment decisions. Customer fixation is critical to success. With markets evolving at increasing rates of change, too many companies are overly focused on competitors vs. customers.

In an interview with Inc. magazine in 2019, Jeff Bezos talks of 4 key principles that drive Amazon’s business – Customer obsession, eagerness to invent, long-term thinking and operational excellence. He says, “The first and by far the most important one is customer obsession as opposed to competitor obsession,” he says. “I have seen over and over again companies talk about being customer focused, but really when I pay close attention to them I believe they are competitor focused, and it’s a completely different mentality, by the way.” He then goes on to say ” If you’re competitor focused, you have to wait until there is a competitor doing something. Being customer focused allows you to be more pioneering”. Finally, this customer focus is encapsulated by a quote of his in Blomberg Businessweek, August 2014, “We don’t want to start with an idea and work toward the customer. We want to start with a customer problem and then invent to a solution.” – Jeff Bezos, Bloomberg Businessweek, August 2004

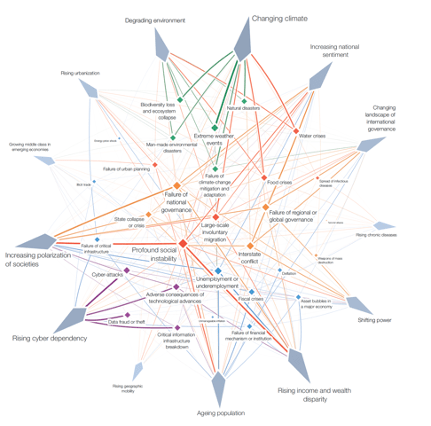

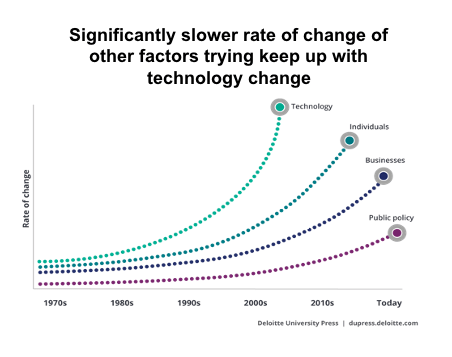

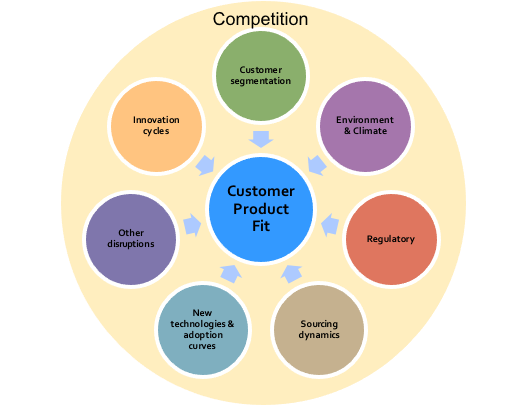

There are a number of factors that are creating a need to think differently by looking at customer – product fit (Figure 8-1). Let me first talk about all the influencing factors and then I will come back to talk more specifically about customers. Firstly, the need to focus on climate and environmentally sustainable products and services will be critical for all sectors with varying degrees of urgency. With climate, leglisation, investor and public demand will be changing the shape and size of many consumer and b2b segments and the specifics of the product and service offers. For example, will your sector need or want to move from short cycle products (use – dispose) to long cycle products (eg. use – upgrade – resell – recycle), or go from a product purchase model to an asset sharing model. Understanding how market segmentation will change as a result of both customer purchasing habits responding to the issue and other market requirements is essential to explore.

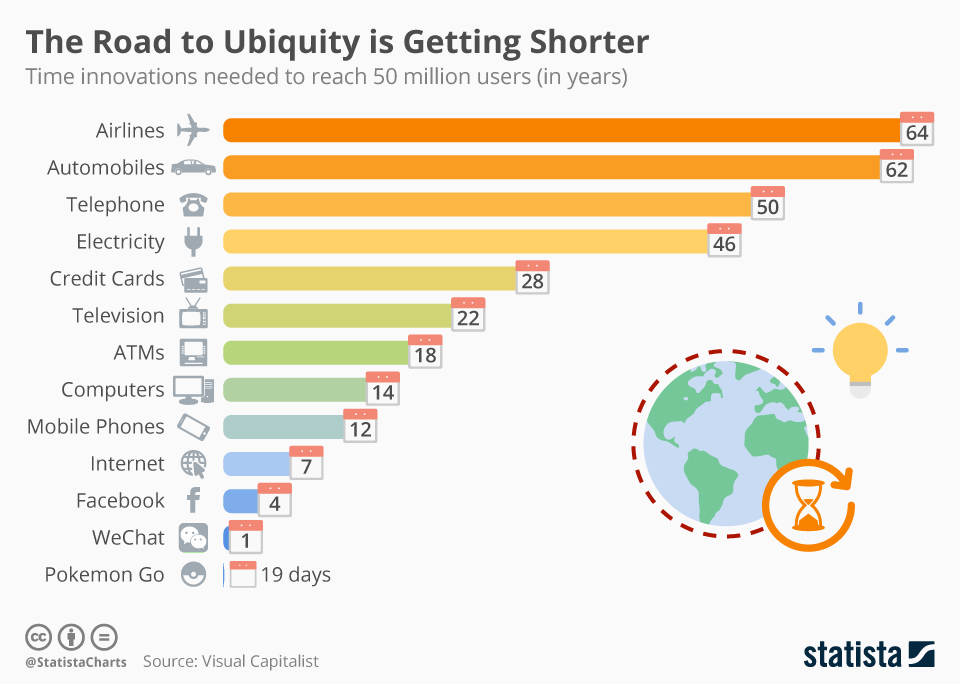

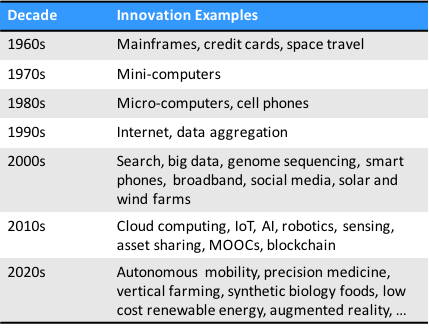

Secondly, the need to think about fit requires evaluation in the context of different time horizons. For example, music has shifted in delivery format from LPs to cassettes to downloadable to live streaming. With the acceleration of new technologies emerging many sectors will see fast and significant changes in what needs can be met, the design and delivery of the product or service, the payment models, the post-sale experience and the after-use experience. The time between ‘new normal’ customer and market environments will shrink from a combination of technological shifts, climate change and other major disruptions.

Thirdly, customers increasingly care about the sourcing of products; being on top of shifts in this thinking will be critical. This care, and ultimately how they vote with their pockets, can link to environmental concerns (eg. deforestation), social concerns (eg. fair trade, child slavery, desire to buy local) and geo-political views (eg. anti-China).

Fourthly, creating scenarios of potential market and competitive environments in the future will be more important than deeply understanding the current competitive environment. The combination of new technologies, adoption curves of existing known technologies and the shift to sustainable businesses will change the shape of many markets. You just have to think about how different your life was in 2007 when there were no smart phones and apps, limited bandwidth broadband, low data storage, much more limitations to on-line shopping and the use of social media was just starting! When the key success factors, skills and capabilities change for a market sector, there will be changes in competitor sets and the dynamics between them.

Finally, with your customer – product focus what kind of innovation cycles will you need to stay relevant? This isn’t just what we think of in terms of rapid ongoing upgrades to an existing product; rather, it is thinking about the time periods and likely fundamental shifts that the product or service may require to stay relevant. All these factors can have a material bearing on customer – product fit going forward which is where strategy is focused.

Now back to the core thinking about customers. I will focus on thinking about the dynamics in consumer markets, and then discuss business to business (B2B) markets. I am amazed at how many people rely on impressions of what is happening that may well be 20 years or more out of date. Two great books that deal with this are Enlightment Now by Steven Pinker and Factfulness by Hans Rosling. Challenge your executive team, and Board, to go through the 13 questions that Hans Rosling asks to see how current your thinking is on the world today. Most groups that do this will be surprised by how much their knowledge is out of date. Our knowledge base tends to be heavily biased by what is newsworthy as opposed to what is actually happening. Up to date facts and knowledge is critical to picking the right geographies and customer groups to focus on; and, deeply understanding target customers and the potential market and product dynamics linked to them is fundamental to growth.

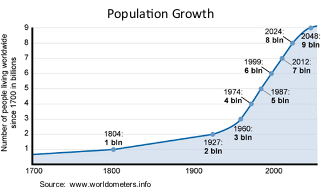

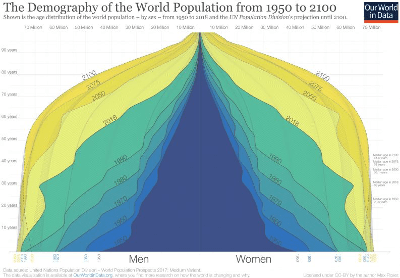

At the macro level, the global population continues to grow. We are now approaching a global population of 7.8 bn people and we expect to hit 10 bn people by 2055. The dynamics of this growth have changed and will change significantly over time (Figure 8-2).

This is a growth rate of about 1.05% per annum currently which is expected to decline on an ongoing basis until population growth has virtually stopped by 2100. The population growth rate was as high as 2.05% in the period between 1965 and 1970. A tremendous change occurred with the industrial revolution: whereas it had taken all of human history up to year 1804 for world population to reach 1 billion, the second billion was achieved in only 123 years (1930), the third billion in 33 years (1960), the fourth billion in 14 years (1974), the fifth billion in 13 years (1987), the sixth billion in 12 years (1999) and the seventh billion in 12 years (2011). During the 20th century alone, the population in the world has grown from 1.65 billion to 6 billion. (Source: worldometers.info, UN Nations – World Population Prospect: the 2019 Revision (June 2019)). In the 21stcentury, the population is expected to grow to about 11 bn by the end of the century at which point the population will have probably peaked.

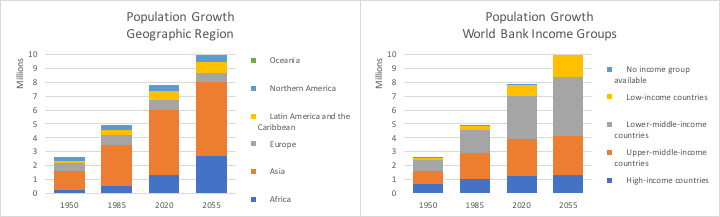

If we then look at sources of population growth from 1950 to 2055 forecasted levels, the sources of growth evolve significantly by both geographic region (Figure 8-3) and by World Bank income classification based on the 2018 country classifications (Figure 8-4). Firstly, from a geographic perspective, the combination of North America and Europe represented 28% of the global population in 1950 and by 2055 it will only be 11% of the population. Europe will start to decline as of 2025, and North American growth will be very slow. Asia will continue to grow through to 2055 and then start to decline; although, the sources of growth will change between countries. Africa will continue to be high growth, and then effectively be all the growth from 2055 to 2100. From an income growth perspective these growth patterns will be exaggerated further as income growth rates are higher in lower income countries.

If you look at growth using World Bank Income Groups as defined in 2018, both high-income and upper middle income group populations growth will have peaked by 2050 and all the growth will be in the lower middle income and low income group countries to 2100.

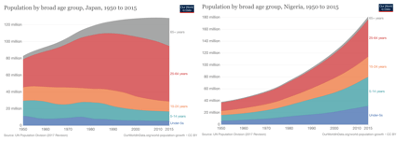

Behind these numbers, there is the other dynamic of population breakdown by age (Figure 8-5). These trends can also cause tremendous shifts in spend as populations age. Figures 8-6, 8-7 show how different the dynamics can be when you compare Japan (the oldest average age country and a declining population) with a large high growth country young country such as Nigeria.

Clearly these dynamics then need to be overlaid with consumption patterns and income availability to really understand and define opportunities.

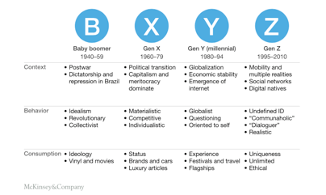

The last aspect of B2C customer – product fit that I want to talk about is customer purchasing behaviour. In consumer markets, we have gone through the different generations from Baby Boomer to Gen X, Y and now Z (Figure 8-8). There have been massive shifts in attitudes, behaviours, purchasing and consumption. These shifts cause great challenges across many businesses ranging from hiring, to work expectations and work environment practices, and clearly also to consumer spend on product and service offers.

Through the generations, and with technology changes, we are seeing major changes to consumer spend in a number of ways. Firstly, in the mix of spend such as shifts from products to experiences and trends towards wellness. Post Covid 19, I think we can expect some further shifts in the mix of spend, perhaps less travel and more spend on the home. Time will tell! Secondly, there is the evolution of functional needs within product categories; for example, towards organic in food, or simplicity, time saving and integrateability in more technical products. The functional elements then also blend in with the emotional factors, the third category. These would include the potential need to express individuality, badges/brands for association, design, local vs. mass produced, etc. Finally, there are some overall higher level themes that would go across sets of product categories linked to social responsibility and ethics such as climate, ethical sourcing and fair trade. Being on top of these trends and understanding the link back to customer needs and segmentation is critical strategically.

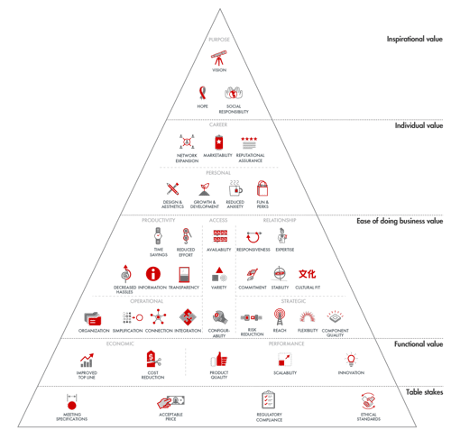

As with consumer purchasing, B2B markets have similar complexity and an ever greater importance of understanding technology and innovation trends that will affect a companies mix of spend and specific purchase criteria. Bain & Company, my alma mater, has done some excellent work analysing and categorising the most important elements for a purchasing decision. Figure 8-9 is their Elements of Value pyramid for B2B buyers. Across industries, the most important factors will vary; and then, within an industry, markets will segment against certain clusters of factors.

Properly, identifying these market segments and then understanding them is essential for properly mapping customer – product fit.

In summary, focusing on a clear existing market is essential; however, understanding how the market will evolve and purchasing patterns may change is what will drive the sustainability of your market opportunity. All of this starts with truly understanding a company’s target customers and their needs and problems that they are trying to be solve. This knowledge will drive investments, how you organise and focus your innovation initiatives, and your ability to compete and outperform.