In the last blog, I talked about the critical interlinking of economic growth with technological progress.

There are 3 key themes linked to technological development today. Firstly, the general need for continued investment in research and development. This has driven higher levels of economic well-being and overall economic growth. Economic growth and the level or research and development are inextricably linked. Historically, the majority of investment funding in basic research is provided by the government and other non-business sources. In applied research, the spend is more evenly split between business and non-business sources. Development is dominated by the business sector as they have clear sight on potential economic returns.

Investment in both research and development are needed to continue to drive economic growth. Continuous breakthrough research as well as development spend to innovate new products and services is sustains growth over time. Concern over the reduction in investment by governments is legitimate as the business sectors primary focus is on the later stages of R&D and not on fundamental breakthroughs, such as the invention of the internet.

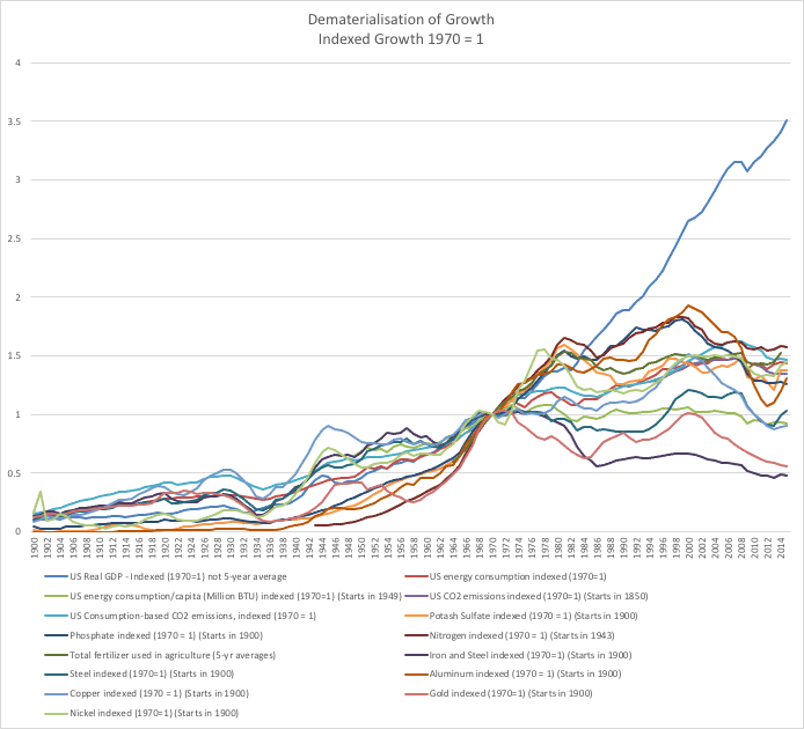

Secondly, the impact of technology to drive dematerialisation and help solve our challenges of driving our existence on the earth to a Net Zero position in greenhouse gas emissions and address the need for biodiversity regeneration. We need to continue to overcome the Malthusian view of disaster scenarios from exponential population growth coupled with only arithmetic improvement in the utilisation of scarce resources that would periodically cause major crises for the human race – often in the form of major population corrections. In 1968, Paul Ehrlich’s best seller “The Population Bomb” warned of mass starvation and societal upheaval. He warned that the battle to feed all humanity was over. This was coupled with the 1972 Limits to Growth warnings. Technological progress helped to ensure that these major corrections and catastrophes did not happen. However, many of these challenges continue and there is still a lot more progress needed to solve these challenges to move in to a position of some form of balance.

Thankfully, we are now seeing a decoupling of economic growth and resource use, slowing population growth, and an increasing ability to fully overcome the challenges that Malthusian thinking predicted. Along with the dematerialisation, is the current, near term and in sight availability of technologies that can help us shift to a carbon neutral footprint and a declining ecological footprint on land and in the seas.

Thirdly, the development of new technologies vital to contributing to providing inclusivity and fairness across the world. We have made great strides in reducing the levels of extreme poverty which are now below 10% of the worlds population from a level above 40% in 1980. Inclusivity means access to food, shelter, energy, quality health services and education, and to economic opportunities for all. New technologies have and must continue to provide cheaper and more abundant access to products such as high yield drought/flood resistant grains, clean water, continuous provision of energy, new vaccines and medications, internet (included access devices) for remote working, education, telemedicine, etc.

There is a long way to go to providing an improving way of life for the billions falling far short of the basics, let alone addressing the growing issues of inequality. Technology and innovation focused on creating abundance in key areas is an essential ingredient for this this quest. Fundamentally, a core role of technology is the conversion of what’s scarce and making it abundant – eg. energy, water, health, learning, time, money, expertise and resources. The critical components of abundance are dematerialisation, demonetisation and democratisation of technologies. These factors are also drivers of economic growth.

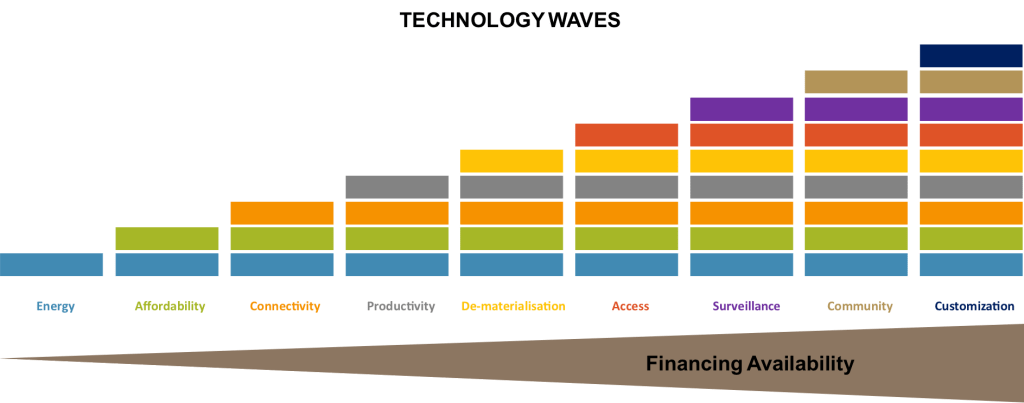

Innovation waves have contributed to economic growth by reducing cost, adding choice, improving the performance of a product, improving the value for money, growing existing markets and opening up new market opportunities; all of which contribute to growth. There are different ways to think of the drivers of growth; but, I like to think of these innovation waves of growth driven by additional forms of value add to the consumer rather than by the specific technology type. I have defined these innovation waves by the benefits they provided rather than the name of the sets of technologies behind the waves. Underpinning these benefits driven new innovation waves has been an increasing availability of finance to further invest in the technologies and related market innovations, and in businesses overall to create and build the markets. I have defined nine innovation waves that we have seen to date. (see Figure 6-1).

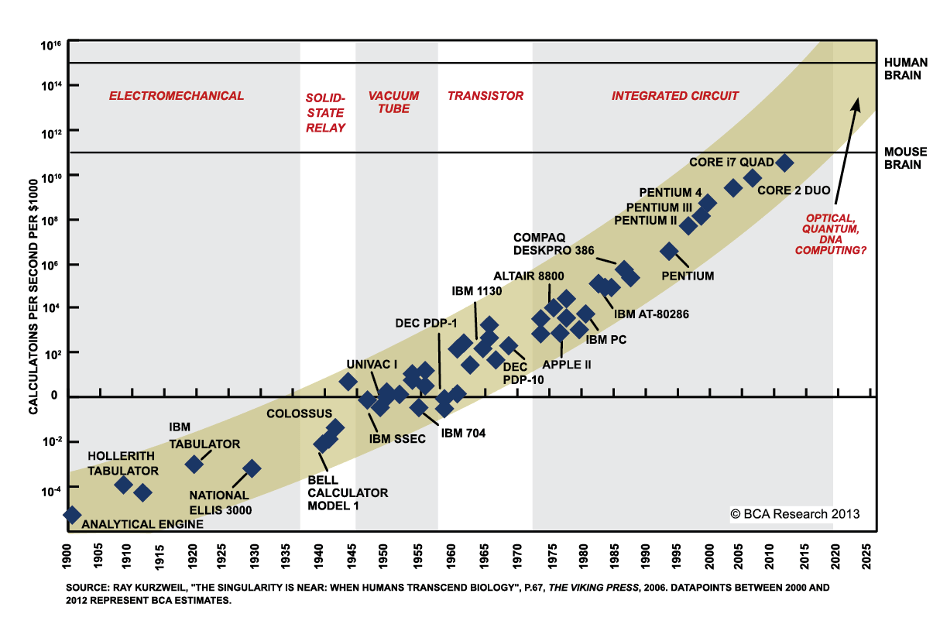

Each wave has a point where the initial technologies become robust enough to be converted into economic products, and then through further research and continuous innovation they continue to expand market opportunities and drive growth. Perhaps the most well known example of this is Moore’s law on the development of integrated circuits. Moore’s law is the observation that the number of transistors in a dense integrated circuit (IC) doubles about every two years. Aligned to an increase in performance of a transistor has also been the remarkable drop in cost. The combination of the two has driven the affordability of computing power, the capabilities of it to grow and impact almost every market sector and in multiple ways. Computing power is now moving to being ubiquitously available through smart phones. Continuous improvement requires both research and development. In the case of transistors, as noted in Figure 6-2, this requires new technologies to continue to drive the wave. As with transistors, they moved from electromechanical technology through to solid state relay, vacuum tube, transistor and integrated circuit technology.

These innovation waves that provide new and different forms of economic growth, effectively layer on top of each other. Innovation then also happens vertically through the integration of different technologies into new solutions.

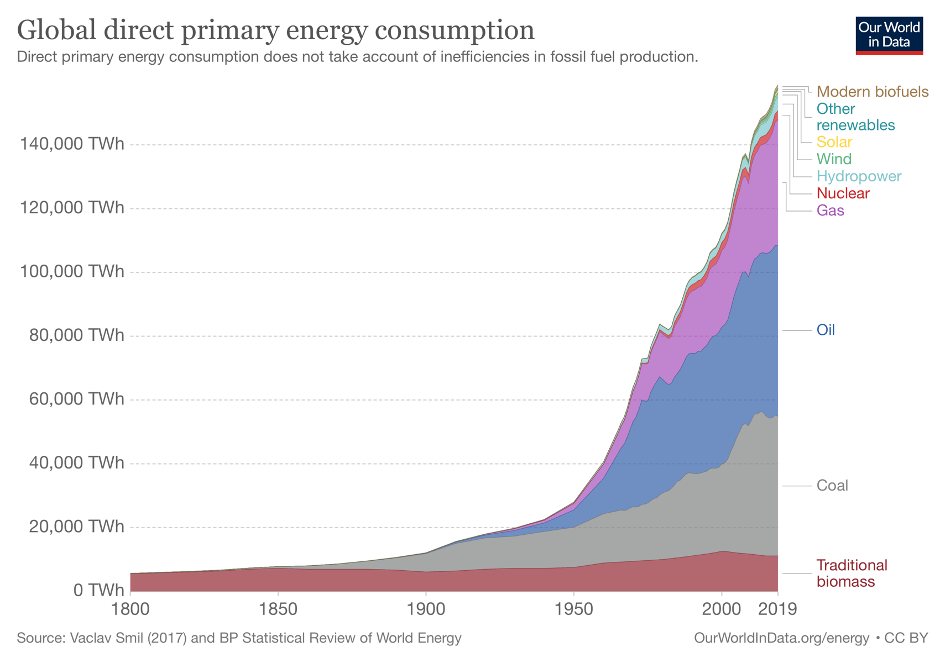

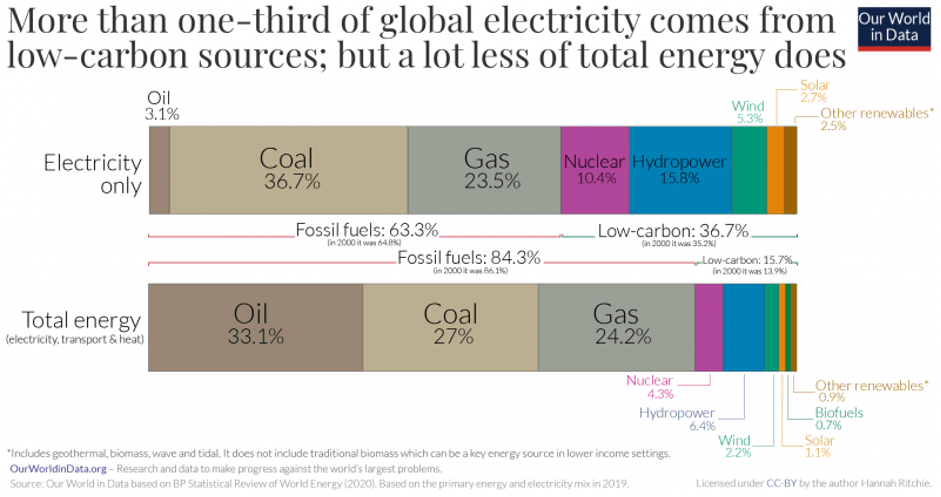

Starting with the first wave of energy. Energy comes from many primary sources, including coal, steam, oil, hydro, gas, nuclear, geothermal, solar, wind, hydrogen (See Figures 6-3, 6-4). About 27% of this energy is then converted to electricity and delivered through an electricity grid. Energy effectively underpins all economic growth as it allowed the development of industry for mass production and provision of products from consumption. It provides key factors of production such as heating, cooling, lighting, the development and use of production lines. Continuously available energy underpins economic growth. It is what is required to power all other technologies and innovation waves.

The second technology wave was affordability which was driven by industrialisation (Figure 6-5). This transformed the production of goods from masses of artisans with cottage industries to the mechanisation and use of steam energy to produce goods more efficiently and then on to mass production with assembly lines. This transformed the availability of a product as well as dramatically reducing the cost of the product to create economic affordability. Industry 3.0 saw the introduction of computers, automation, and electronics into production, and Industry 4.0 continues the trend towards automation and data exchange in manufacturing technologies and processes which include cyber-physical systems (CPS), IoT,[31] cloud computing, and artificial intelligence among other technologies.

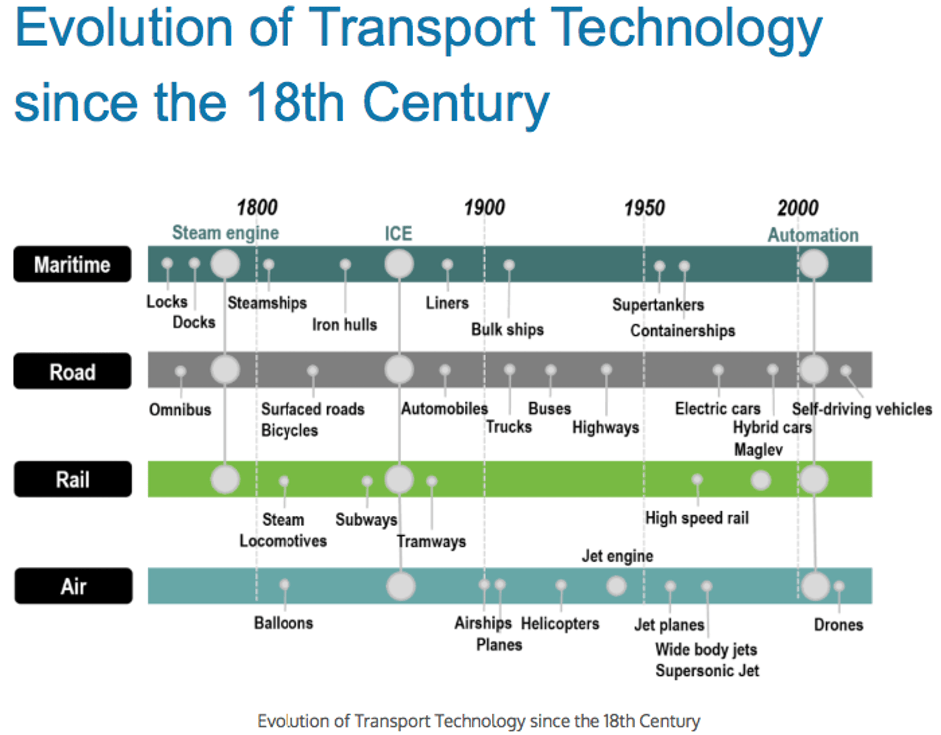

The third innovation wave, I have coined as connectivity which is comprised of two vital components. Firstly, transport which has driven the mobility of resources, people and products which has dramatically transformed the local ability to produce products and source resources and products; and, for the consumer to personally access new products and services. The evolution of mobility has transformed markets and created many new markets (see Figure 6-6).

Figure 6-6

The second part of connectivity has been the development of communications technology, which has opened up markets from the ability to transmit information to, or market to, larger and larger numbers of people cost effectively. Although, the telephone was invented in the 1876. The mass adoption of the analog telephone did not really start until post 1900. The evolution of communications has been particularly visible post 1980 (see Figure 6-7).

Figure 6-7

The combination of being informed of what products and services are available and being able to increasingly access and cost effectively purchase them has created dramatic economic growth.

Fourthly, the productivity wave started with the invention of the computer. This began with the mainframe, then the mini, micro, portable computer, tablet and now the smart phone. The driver of this has been Moore’s law (see Figure 6-1). Aligned with the increase in computing capacity there was also the reduction of cost which drove the adoption of computers from a few to making them ubiquitous across companies, large to small, and individuals. The initial focus of computers was on mass replication of simple tasks often related to administration. The use has now moved to all areas of a business including manufacturing, supply chain management, customer service and relationship management, human resource management and enterprise resource planning. Much later in this wave has been the availability of hundreds of applications that sit on our ‘always on’ smart phones and drive our personal productivity.

The fifth wave of de-materialisation has come in many forms from simply reducing material usage, to miniaturisation, to transformation of physical product to digital products, shifts to lower cost and better performing substitutes, to a consumer focus on services and experiences.

The pathways to de-materialize a product include:

- Optimize – maximize resource effectiveness by reducing the mass or changing the material types in the product, or improving the utilisation of a product

- Digitize – sell and/or deliver the product electronically or virtually

- Servitize – sell the utility of the product as a service

A simple example of product dematerialization is the transition in music from physical CDs to digital MP3s to a mobile application for music such as Spotify.

The 6th innovation wave is access. This is the first wave of value derived from the emergence and adoption of the internet with common protocols for communication, connectivity and sharing. In many ways, the internet was seen as an opening up of the world and carried the potential to be a great equaliser. This was the birth of Google with their early mission “to organize the world’s information and make it universally accessible and useful”. Low cost, or no cost, access to information and knowledge from across the world, visibility of goods and services from anywhere in the world and the decline in the limitations of geographic boundaries expanded market opportunities. As a great example, we have seen the Khan Academy and MOOCs (Massively Open Online Courses) such as Edx, Coursera and Udacity delivering education remotely across the world. We have also seen the mobile wallet, such as MPESA in Kenya, transforming the vibrancy and economic opportunities within the slums and for the lives of the ‘unbanked’.

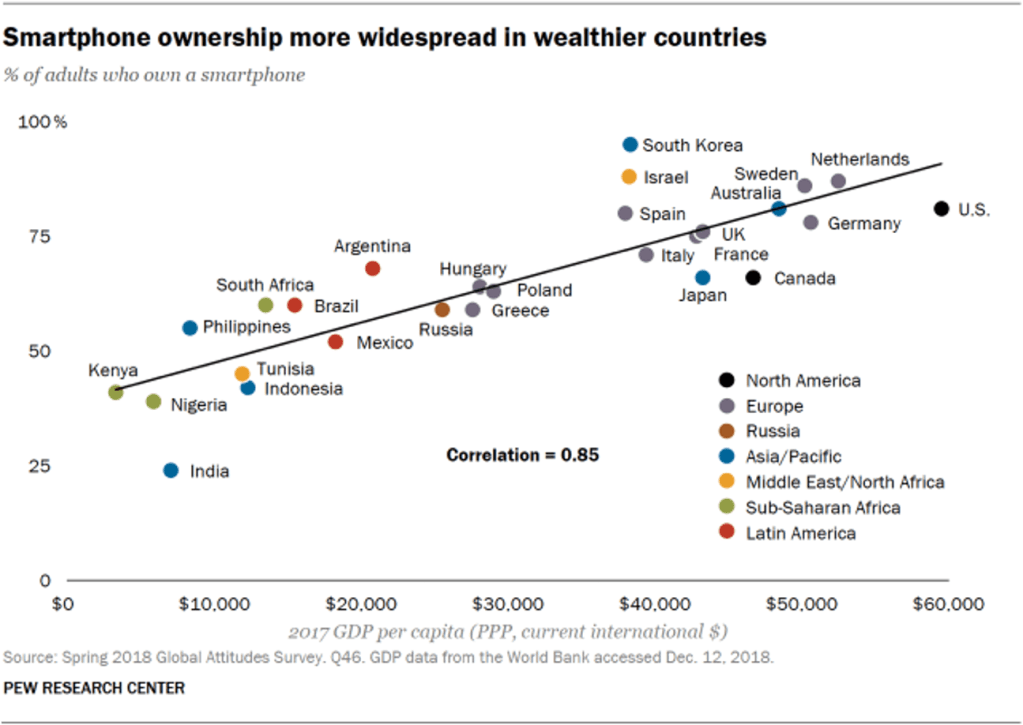

Probably, the best measure of where we are today on access is the global penetration of smart phones (see Figure 6-8). Great progress has been made; but, there is still a long way to go. From today, there will be continuous development of devices, new ways to deliver internet access to more and more remote areas of the world, new generations of cellular networks to change the power and value of access to the internet, and continuously reducing costs of access and usage.

The 7th innovation wave is surveillance which is the name that I have ascribed to what many would think of as customer data and big data. Surveillance recognises that the ability to create value is closely linked to the use of data on a timely basis. Real time delivery of value related to product performance, the behaviour of people and changes in their context provides much higher value than lagged delivery of responses. In fact, preventative based services in response to predicted potential outcomes are likely to be of the highest value. A simple example of this would be the automated breaking of a car to prevent an accident. In the health sector, early or at risk identification of cancer vs. later stage identification is transformative in terms of life outcomes.

A broad array of technologies are involved in this wave, starting with observational technologies related to video, audio, text and sensors which could be gathered from devices ranging from smart phones to space satellites. Secondly, there are technologies such as data storage, computing power, and AI that need to take the data, analyse and interpret it and decide what actions, if any, need to be taken. Finally, there will be technologies related to the integrated delivery of the service, such as IoT, to create the value.

The concept of surveillance can be seen from both a positive and negative perspective. On the positive side, it can for example help improve food yields, improve responses to potential tragedies, improve the performance of products and help drive better health and longevity for people. For consumers, it can also improve the timely delivery of information, provide product suggestions, personalise the delivery of news and entertainment, and in general generate value into almost all parts of our life.

The negatives side of surveillance technologies has become particularly visible through the behaviour of Facebook and Google. This is the unknowing gathering and use of private data of private citizens. We have all experienced how apparent private conversations seem to trigger related product offers or serving of content in social media platforms. We have also seen how this deep pervasive knowledge of individuals coupled with fake news is used to attempt to mass manipulate voters on a one to one basis. There is also the potential misuse of genetic information to drive decisions such as the cost of insurance. Surveillance raises complex moral, ethical and legal questions linked to rights to privacy, access to information, use of information and the ability to generate and distribute different forms of false information.

The 8th technology wave is community. This is the recognition of the benefits to the individual and society from thinking and behaving in the form of community. Community comprises three variations – crowd based developments, asset sharing, and community based technology applications focused on solving climate, environment and inequality challenges.

Crowd based applications include crowd sourcing, crowd financing and crowd solving. Crowd sourced applications and open IP are increasingly popular. Examples include the linux operating system, Wikipedia, and GitHub. Github is where over 56 million developers work as an open source community.

Crowd financing is the practice of funding a project or venture by raising small amounts of money, often through the internet, from a large number of people. In 2019, the estimated global market size of crowd funding was $14bn and it is projected to grow to $40bn by 2026.

Using crowds to help solve complex and/or time consuming tasks is increasingly prevalent. This can range from taping into the global community of stargazers to find new stars and constellations, to Elon Musk’s recent $100m prize competition to fight climate change.

The idea of sharing the use of an under-utilised asset is not new. What is new is focusing this idea onto converting private assets into scale businesses such as Uber and AirBnb. This transforms the cost of access to a range of assets and services. Another application is where businesses can benefit from sharing the use of an expensive or complex asset. Cloud, app and SaaS (software as a service) platforms are a great way to do business in a way you couldn’t afford to do on your own, or to reduce the cost of use or cost effectively manage highly variable or unpredictable scalability requirements. These platforms have transformed the costs of starting a new business. In August 2020, Research and Markets issued a report saying that the global cloud computing market was expected to grow from $371bn in 2020 to $832bn in 2025.

With the focus on solving climate, environment and inequality challenges there is increasing attention on serving the underserved and providing real solutions for remote locations. Community oriented solutions will often be the answer. These applications will help address climate based challenges, water access, improving health outcomes, access to continuous energy supply and internet access and use.

The 9th and final wave is customisation. This may sound like a reversion to artisanship; however, it is the concept of mass customisation that can be done at increasingly lower costs over time and reach large potential markets. It is also not personalisation, as in “what colour would you like” or “would you like it gift wrapped”. Rather it may well be something truly unique and relevant. This is the last phase of the trend from mass production to segmentation to specialisation to personalisation to mass customisation. Examples range from precision medicine based on each person’s specific genetic make-up, full configurability of personal products such as Nike’s custom building of shoes (see Figure 6-9), cost effectively digital printing truly unique products, or truly customising SaaS software for the unique requirements of a company.

3D printing provides extraordinary opportunities as it moves into even more materials and can produce cost effectively products of different scale. It is already being used in products such as prosthetic limbs and body parts, clothing and fashion, building products, furniture, products for space and aircraft parts.

There is no reason to think that the innovation within each wave has to crest and fall. Continuous R&D will cause new surges of opportunities within each wave. As new technologies are developed within one wave they may well apply to a number of the other innovation waves. We have seen how digital technologies and the internet now touch all the waves. Each new layer of technology can create multiple new opportunities and those opportunities only expand as combinations of technology are put together to create new products and services. The autonomous car movement, that is developing, combines multiple technologies that were developed within different waves – clean energy, electric engines, battery storage, robotics, AI, scanning technology, GPS, etc.

The importance of the inter-relationship between economic growth and technological innovation should be not be underestimated. They both provide fuel for each other. This should not be forgotten as we look to solve the climate, environment and inequality challenges. New technologies and innovation creates solutions and economic growth finances them and creates accessibility.

In my next blog, I am going to talk in more depth about the first of the three challenges I identified in the first blog of this series – decarbonisation and biodiversity regeneration.

#technology #innovation #access #affordability #biodiversity regeneration #climate change #economic growth #inequality #energy #affordability #industrialisation #connectivity #mobility #productivity #dematerialisation #access #surveillance #community #customisation #Moore’s Law