Blog 9 of the Business Strategy Series

The natural subject to follow on from customer – product fit is to explore business models. The business model definition in the context of this discussion is, the economic model for profitability that joins the value proposition to the target customers with the delivery model of resources and processes that need to be combined to meet the customer need, and to build and grow the business.

It is critical to understand that the three components, the value proposition, the set up to deliver the value proposition and the economic model are all intertwined. As an example, in the US you might ask how does everyone seem to own a car and regularly get a new car. Surely, with the level of debt in America, most people don’t have the available cash to buy a new car! The answer is that if you combine lease financing with a car you can expand the market by reaching a whole set of customers with limited or no savings, who can make payments out of their monthly pay. In the case of General Motors (GM), you have GM the car manufacturer and GM Financial the lease provider. The combination of the two provides the value proposition of a new car based on monthly payments and drives the overall profitability of GM from both product margins and financial margins from the leases.

A more modern example is AirBnB who are the biggest providers of rooms for short term accommodation. They do this without owning any real estate. They have crowd sourced the rooms, they then pay for them and resell them on a variable cost basis. AirBnb effectively then takes an intermediary margin to drive the economics of their business. Both of these examples show how the economic model is an integral part of the value proposition and also dramatically affects the scale opportunity for the business. Business model innovation, with innovation within the economic model, is a critical component in the development of new successful businesses.

There are five key economic dimensions of the business model that I will explore. The first dimension is who pays. Is it the customer who pays for the product or service or does someone else pay – these are direct or indirect models. One of the earliest versions of the indirect model is a newspaper or magazine that is free, and all the revenues are made from ads placed in that media. The companies placing the ads are indirect beneficiaries of the consumer business if the ads generate revenues for the advertiser.

Today two of the FAANGS (5 prominent American technology companies – Facebook, Apple, Amazon, Netflix, Google) have a core model that the consumer does not pay. They are Facebook and Google. These two companies make most of their money from the placement of ads in the web pages of their consumers. In these digital models there are also opportunities to make money off the consumer data that they collect. The reality of these economic models, although it may not be obvious, is the user of the service is the product and the economic customer is the advertiser or purchaser of consumer information. The internet spawned a large movement towards this model; although, many companies have found that ad revenues alone are not enough and a hybrid model is usually required.

The second dimension is the economics of revenue growth. There are two fundamentally different types of revenue focus, product focused (transaction oriented) and customer relationship driven. The economics of the two models are very different and best suited for different situations. In the transactional model, the sales, marketing and service costs related to the sale are covered within the profit margins of the product/service sold. In the economic profile of a customer relationship focus, the upfront costs of finding a customer are often expensive; however, as long as you capture customer information and are able to market to them subsequently the follow on marketing and sales costs to a customer can be very low. If this is matched with a product offer that you have reasonable expectations you can generate recurring revenues, and ideally growing revenues over time, then you would be willing to lose money on the first purchase and make the profit up in subsequent purchases.

In the early days of Amazon, there was always wonder at how the economics of Amazon made sense as they were unprofitable for years. If you look at it from a customer relationship perspective it was clear that when you have a high growth curve your focus is on new customer acquisition and each new customer at the beginning of their relationship is a loss maker. Jeff Bezos clearly believed from books and then adding new product categories that the lifetime economics of a customer would be positive and this was a critical part of his economic model.

The third dimension is revenue payment model. There are a number of payment timing approaches in a model which include individual purchase, periodic purchases (unstructured buying over time) and subscription payments.

These three dimensions are captured in Figure 9-1. The indirect model of who pays is captured in the ‘Free’ column. In the free column, if a customer never makes a payment then the revenues for the organisation needs to be collected from interested intermediaries. In the grid, you can see that for digital companies that involve high frequency of use, often the right model is customer focused and subscription payments. In contrast for non digital, companies such as FMCG companies and physical retailing where it is difficult to capture a name and efficiently use it, they will tend to be product focused. Many of them try to become more relationship oriented by adding a loyalty program to a standard offer.

Often, there are companies that use a freemium model in the digital world. A freemium model of a no cost low specification software application can often be an effective way to create a low cost of customer acquisition by offering a free trial product and then by watching their behaviour to trigger opportunities to upgrade the customer to a paying version of the product. Spotify uses a variation of this model, where you can use Spotify for free if you are willing to put up with a regular flow of irritating adverts. To get rid of this negative experience and then enjoy the full benefits of Spotify you take on a subscription. From a Spotify perspective the ad revenues for a free customer is an offset to the customer acquisition costs for creating a subscription customer. Spotify understands the large network benefits of having as many customers as possible using their service, so freemium pricing is a critical component of their strategy to be a leader in this sector.

This matrix, product vs. customer focus, and the revenue payment model are the two standard ways that most companies look at their business model.

Many companies are now adding additional dimensions to their thinking about what the right proposition is to the customer and how the financial models works for the business. The fourth dimension relates to how the product/service to the consumer is financed in relationship to the payment from the customer. In this dimension, the standard approach is that the consumer pays the full value of the product or service at the time of purchase. In this context, the company needs working capital financing for the product until a customer comes along.

At the other end of the spectrum, the company will build up a product offer for the market by working as an intermediary effectively selling other peoples products. The company may pre-buy inventory for resale, or crowd source product (eg. AirBnB) where they only buy a product or service when there is a need. Crowd sourcing is a working capital and asset light model and the key is to solve how to add value in the middle as an intermediary. Many people will refer to these businesses as market platform businesses.

The final approach within this financing dimension, is what I have call provider financed. In this case, the company has financed the asset and then provides the product as a service so the company only gets full financial coverage on the asset from multiple uses and/or multiple customers. This can help significantly expand the market by taking out the affordability issue in the use of the product or service. This is also known as an asset sharing model.

With the focus now moving towards climate and environmentally friendly businesses, business models that are focused on high asset utilisation should have an important role in our lives going forward. One of the sectors, where this is often talked about is the auto industry. It is clear that cars are used only a small fraction of the time that they are available for use. It is thought that if cars were in a high asset utilisation model, then we might only need about 10% of the cars currently in circulation. This movement may also accelerate with the shift to autonomous driving vehicles.

This leads us to the fifth and final dimension within business model that I want to focus on. With the drive towards making businesses climate friendly, and the growing recognition that asset sharing is an interesting opportunity for both the customer and the asset owner, there is a growing movement away from asset ownership towards ‘use’ and ‘result’ focused business models.

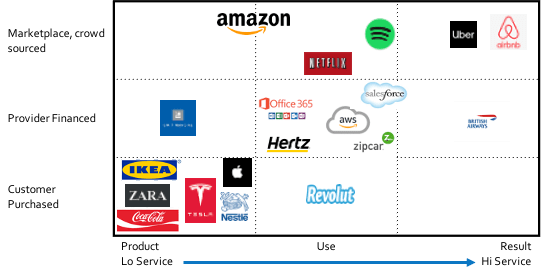

Once again within the automotive industry, we can see examples of each of these three models (Figure 9-2). At the product focus end of the spectrum are the automotive manufacturers which include Toyota, VW, BMW, Mercedes, GM, Ford, Fiat, Renault, Peugot and the new entrant Tesla. In the service focus part of the market, there are all the rental car companies and then new entrants such as Zipcar. Zipcar is a highly convenient rental service to use the car as you want. The service features include highly convenient pick up and drop off, a clean car, a full tank of gas/petrol, insurance and simple payment with all inclusive pricing. Many consumers in urban environments are shifting to not owning a car and just paying per use. At the results focus end of the spectrum, you have taxis and more recently Uber, and equivalent crowdsourced point to point personal transport service providers.

If you were a large car manufacturer today, or a major player in the supply chain, facing a shift to electric cars, all the climate pressures, the emergence of crowd sourced / asset sharing companies, and in the medium term the growth of autonomous driving vehicles, what would your strategy be?

The mapping of the asset financing dimension and the product-service dimension provides and interesting look at the strategies of different companies (Figure 9-3). An interesting business model to look at is Microsoft Office 365. Microsoft has shifted from selling Work, Excel and Powerpoint as individual products or bundled as one off purchases to a subscription model with additional bundling of other services. This has helped to transform their business and economics. They now have a product suite that is an integral part of their ‘cloud first’ strategy that provides a steady monthly flow of income, plus conversion to high proportion of direct sales to capture margins and only nominal additional marketing costs per existing customer for further potential sales. This model also helps to open up additional innovation and cross selling opportunities off their cloud platform. Uber and AirBnb in the marketplace and result box in the grid were able to build multi-billion dollar businesses by leveraging off other peoples assets and driving very simple user experiences.

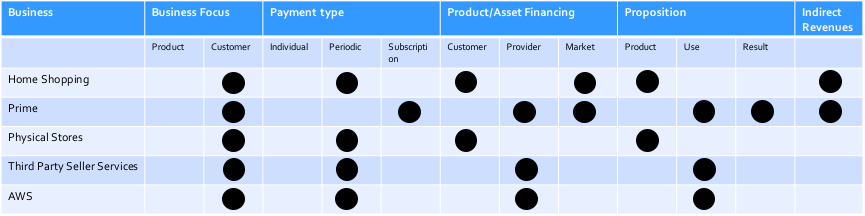

One of the masters of business model innovation is Amazon. Amazon has built a business fortress with innovative use of business models (Figure 9-4). Amazon uses different combinations of business model components for each business. They go well beyond just looking at simple business models and create advantage from multi-factor business models.

All their businesses are customer relationship oriented and collect customer data. The B2B businesses have leveraged off and enhanced the home shopping infrastructure. Each business has carefully focused on how to drive drive growth, optimize the use of cashflow, and generate the long term profitability requirements of the business with a compelling customer proposition.

Going forward, it will be very difficult for anyone to compete directly against Amazon. They have a relentless focus on customers and on how to drive continuous growth and improvement in the relationship they have with them, and they are innovation and execution obsessed. Finally, they know how to use their scale with data, with the range of product and services they provide, and the efficiency of their infrastructure to their advantage. It is no wonder that there is talk about the monopolistic market position that Amazon sits in.

Clearly, there are other factors to explore that drive a business model, including different types of pricing, such as freemium and yield management pricing, and the selection of channels to market, which also have an impact on market size and growth potential, pricing and the cost structure of the business.

There is a real trend of businesses to move from simple business models to multi-factor business models. Different combinations of dimensions will create a business model with different financial characteristics and different market size and growth opportunities. The models create different financial profiles in terms of:

- Upfront cash to get the business started and operating

- Ongoing working capital and growth financing

- Time to self sustaining economics

- Resilience – reliability and predictability of future revenue streams, ability to handle economic disruptions, etc.

- Market size and market growth potential

From a climate and impact perspective it is also critical to identify a sustainable business model. It is essential to explore models that will reduce waste from the traditional product delivery model of take – make – waste, towards a no waste model of being focused on maximising the life of a product/service and optimising the utilisation through reselling, remanufacturing, asset sharing, and finally optimised recycling.

Exploring different business model components is an essential piece of the innovation focus within a business. Creatively looking at whether adding further dimensions to the business model, as Amazon have, or fully switching to a different model, as Microsoft with Office 365 have, is a vital part of business strategy.