Blog 14 of the Business Strategy Series

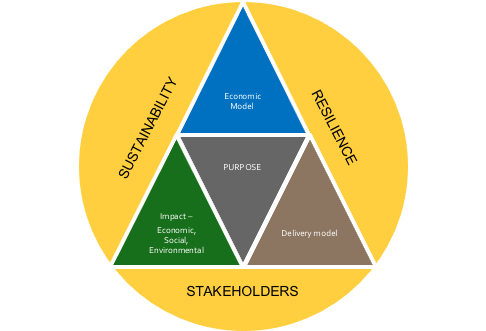

In this second blog describing the strategic framework (figure 14-1), I will cover off talking about the delivery model which is the strategic component behind the purpose of the business that drives both the economic and impact model of the business.

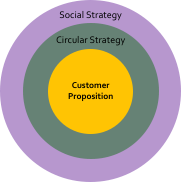

The delivery model aligns the customer proposition with the delivery components that are comprised in a circular strategy, to address climate and environmental impact, and the social strategy that focuses on economic and social impact (Figure 14-2).

Behind all businesses are the dimensions of customer – product fit. The three key strategic pieces of this comprise a powerful proposition to the customer, ensuring the proposition is differentiated from its competitors, and focusing on a market segment that is attractive or ideally large and growing.

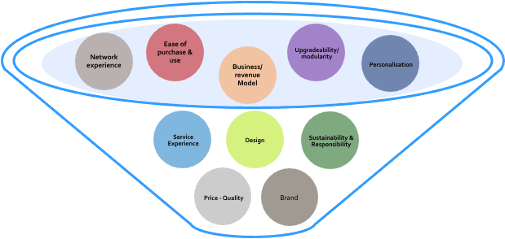

Achieving and sustaining a differentiated customer proposition is critical to success. To this end, having an intense and ongoing understanding of a business’ existing and potential customers in terms of purchasing decision making and behaviours, usage and post-usage behaviours, and the factors that will drive emotional engagement are vital. We can see the potential components of a proposition (Figure 14-3) and the ways to differentiate are growing over time. The newer dimensions include differentiating over environmental sustainability and responsibility, the business model as discussed in Blog 9 of this series including channels to market, and a number of technology based dimensions.

Figure 14-3

In many ways, the bigger challenge is sustaining differentiation vs. the initial achievement of a differentiated proposition. Success attracts copycats. New technology or technology convergence invites disruption.

There are a number of components businesses need to have in place to succeed in sustaining differentiation. Firstly, superior customer knowledge of existing and potential customers. Secondly, and closely associated, is superior CRM (customer relationship management) capabilities. The purchasing and usage experience of a product or service drives customer retention, which results in repeat buying and referrals. Relentlessly improving this experience will be even more critical going forward as the environmental movement drives longer life products and higher levels of service. Thirdly, the collection and use of data, including competitive information. Fourthly, having innovation capabilities and agility to continuously improve, react to problems and opportunities, and to integrate major changes as new technological capabilities. Speed and agility in many sectors are mission critical for success. Finally, none of the other dimensions matter if you do not have the financial capacity to progress on these factors and withstand competitive pressures.

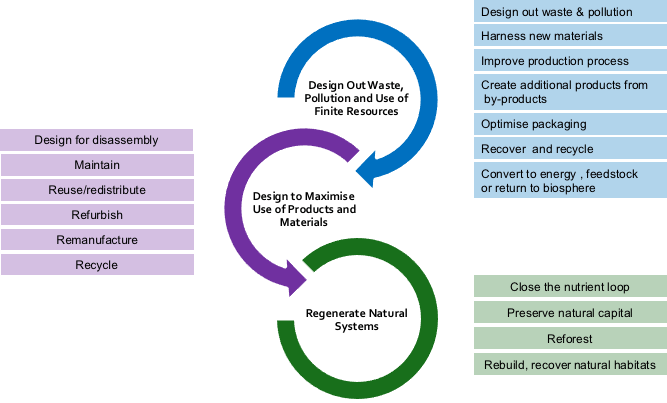

Now let’s move on to look at environmental impact. To truly embrace environmental impact and set ambitious targets from an attitudinal, operational and strategic perspective you need to look at your business through the eyes of a circular strategy. My first exposure to this concept was over 15 years ago when I read ‘Cradle to Cradle: Remaking the Way We Make Things’ by William McDonough and Michael Braungart, where they presented an integration of design and science that provides enduring benefits for society from safe materials, water and energy in circular economies and eliminates the concept of waste.

The book put forward a design framework characterized by three principles derived from nature. Firstly – “Everything is a resource for something else. In nature, the “waste” of one system becomes food for another. Everything can be designed to be disassembled and safely returned to the soil as biological nutrients, or re-utilized as high quality materials for new products as technical nutrients without contamination”. Secondly – “Use clean and renewable energy. Living things thrive on the energy of the solar system. Similarly, human constructs can utilize clean and renewable energy in many forms – such as solar, wind, geothermal, gravitational energy and other energy systems being developed today – thereby capitalizing on these abundant resources while supporting human and environmental health.” Thirdly – “Celebrate diversity. Around the world, geology, hydrology, photosynthesis and nutrient cycling, adapted to locale, yield an astonishing diversity of natural and cultural life. Designs that respond to the challenges and opportunities offered by each place fit elegantly and effectively into their own niches.”

The circular economy is most easily visualised by Figure 14-4 below.

One of the real champions of this approach are the Ellen MacArthur Foundation who have been working with major corporations to rapidly and dramatically reduce the carbon footprint and environmental impact they are having on the planet. Their mission is to accelerate the transition to a circular economy. The Ellen MacArthur Foundation works with business, government and academia to build a framework for an economy that is restorative and regenerative by design. Figure 14-5 identifies the main components of the thinking within a circular strategy.

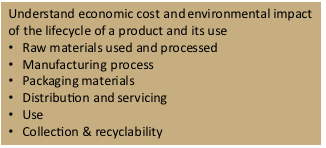

The starting point for developing a circular strategy is to know where you currently stand in terms of both economic cost and environmental impact (Figure 14-6). This sets the business’ starting point.

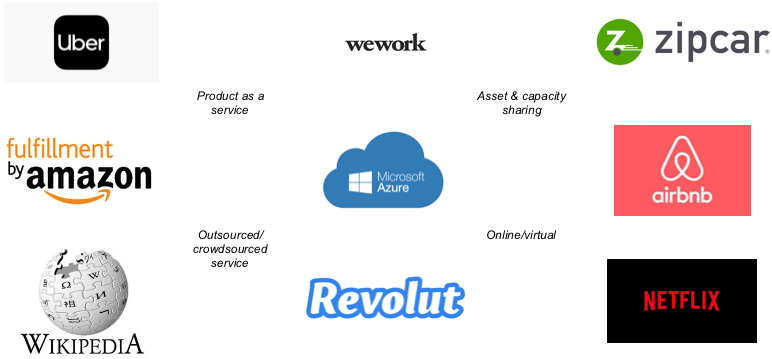

Secondly, explore ways that you can add value and revenue growth by making changes to your business model. Getting the right business model is critical to align with a circular strategy. As I noted in Blog 9 of the series there are many alternative business models that can be explored. Below in Figure 14-7 are some examples of business models of some newer businesses.

Achieving a full circular strategy in product based businesses is a major commitment of time, energy and resources. This also requires full alignment across all parts of the business and its supply chain. Defining the end point allows the business to define the journey and time frame to achieving it in order to deliver on the financial performance and meet the impact requirements of a responsible business.

Integrated with the circular strategy, a business needs to overlay a social strategy, which includes economic impact. I believe the acid test of a strong social strategy is whether or not, or to what extent, the company is contributing in its own way to reducing inequality, ensuring inclusivity, and contributing to future generations of all children being better off. This is positive impact.

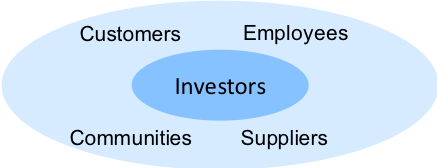

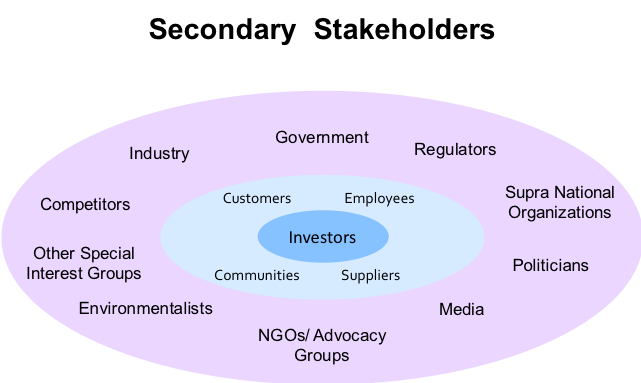

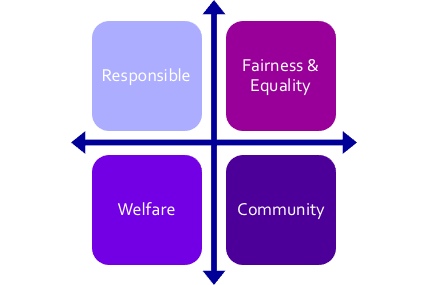

The constituents of a social strategy are the customers, employees, people within the supply chain and communities which are touched by the business (Figure 14-8).

The social strategy can impact on many of the SDG’s (Figure 14-9) including ‘responsible consumption and production’, decent work and economic growth’, ‘quality education’, ‘good health and well-being’, ‘gender equality’, ‘reduced inequalities’, and ‘clean water and sanitation’.

The impact focus of the social strategy will range from compliance with core principles such as anti-slavery, fair trade and gender equality, to specific proactive stances against behaviour that violates the core values of the businesses, or finding areas where the business can add some real specific value (Figure 14-10).

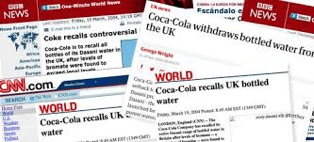

Most recently, we have seen the incident with Patagonia who removed its advertising on Facebook in a “Stop Hate for Profit’ campaign. Alex Weller, Patagonia’s marketing director for Europe said, “It’s no secret that social media platforms have been profiting from the dissemination of hate speech for too long. Facebook continues to be the most resistant of all the social media platforms to addressing this critical issue and so that’s why we decided to take action against it specifically.” Since Patagonia’s stance others like Adidas, Verizon, Coca-Cola and Unilever made similar moves. Patagonia has said that it will stay the course and stand by this commitment for as long as it takes. We will see the strength of the stance of other companies as time passes.

Overall, companies need to think about what their social balanced score card should look like (Figure 14-11).

Just as with the other components of the thinking requiring short, medium and long term views, so does the organisational thinking. This organisational thinking for the organisational components per the McKinsey 7S model (Figure 14-12) needs to be matched against both the time horizons and the alternative strategic scenarios in order to be properly assessed.

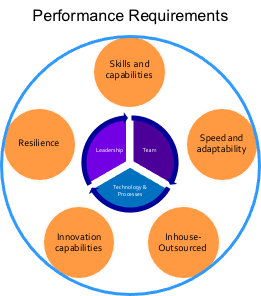

Critically, to get each of the organisational components right there needs to be clarity on the performance requirements (Figure 14-13) of the organisation. Arguably, if there are some big strategic shifts in the business as a result of also needing to drive impact, then there will likely be some material changes required to the organisational needs of the business and linked to this the incentive structure to drive alignment.

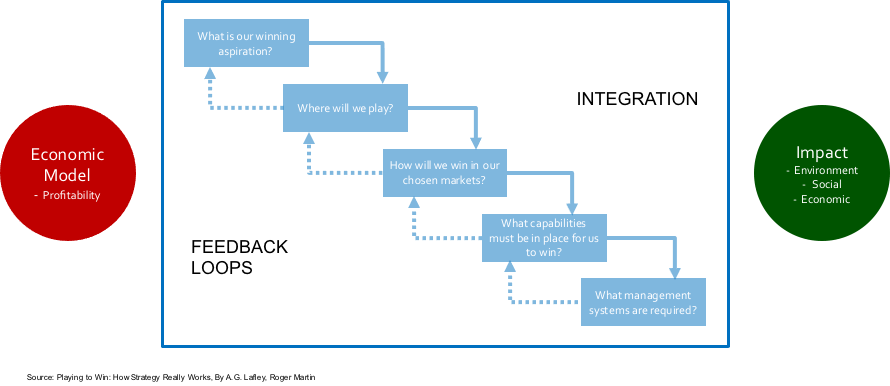

Finally, as the environment changes, the sector evolves and the company learns, there will need to be continuous adjustments to the strategy and the components of delivery in order the achieve both the economic and impact goals of the business. Integration and alignment of these components is critical as well as continuous feedback across the cascade of components with appropriate adjustments (Figure 14-14).

In final blog of this series, I want to talk in more depth about impact, strategic time frames, sustainability and resilience. I will also finish off with a short discussion on portfolio strategy for companies with multiple businesses.