by evading it today”, Abraham Lincoln

Blog 15 of the Business Strategy Series

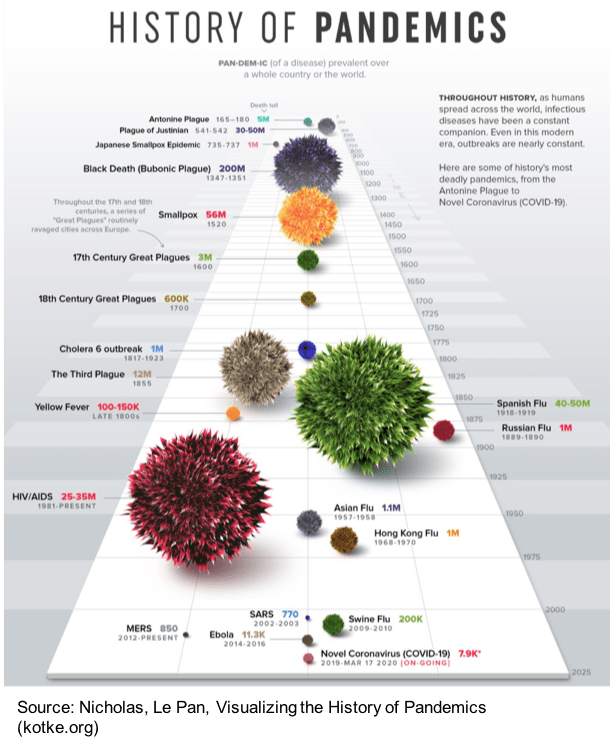

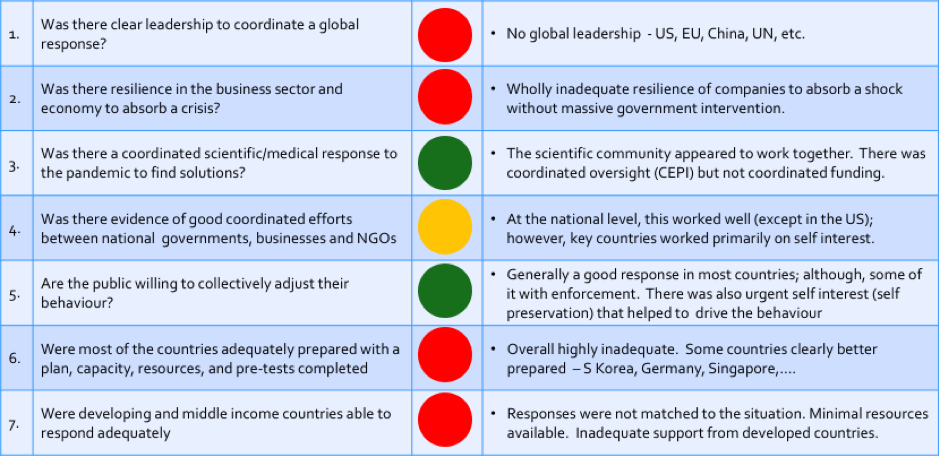

This is the final blog on the strategic framework and of the Business Strategy Series. I will be continuing to write on related subjects. I am also working on another series that will look at the roles and linkages of the market economy and the state – another critical subject as we work through these turbulent and challenging times. A coordinated response between the market economy and governments is mission critical for solving our climate crisis and we can see how vital it is for other disruptions such as the pandemic we have now lived with for 6 months.

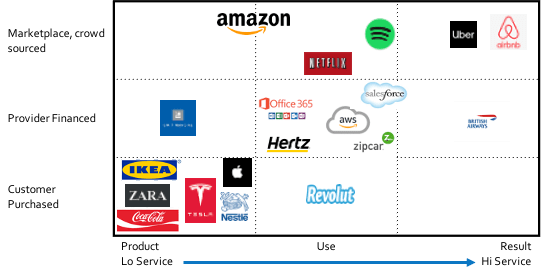

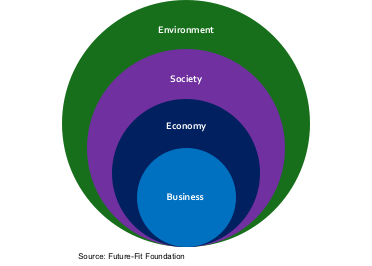

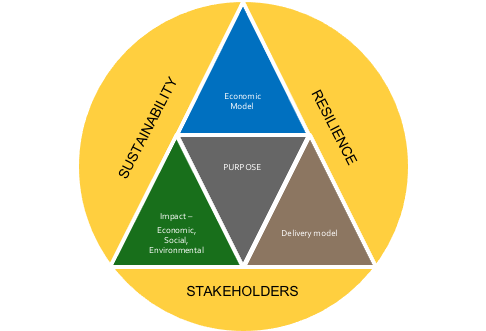

The components in the strategic framework (Figure 15-1) that have been introduced are focused on helping business executives and their boards create a long term sustainable business that has a true purpose in society by delivering both economic returns to investors and impact to other stakeholders.

To date we have discussed purpose and the delivery model. In this blog, I want to talk a bit more about impact, strategic timeframes, sustainability and resilience. I will then complete the discussion with a short piece on portfolio strategy.

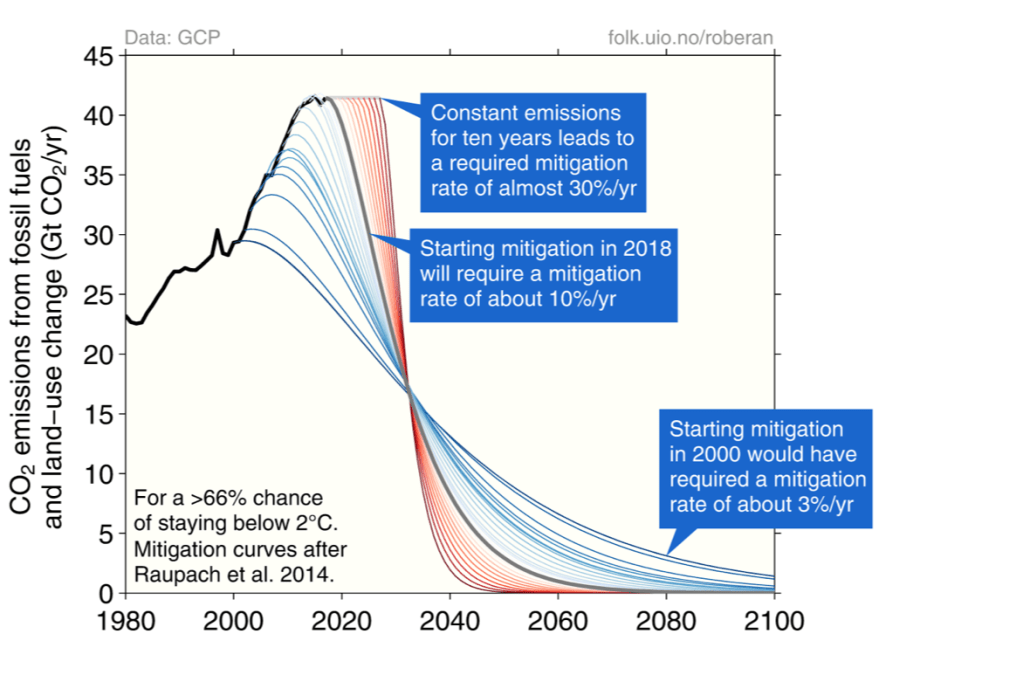

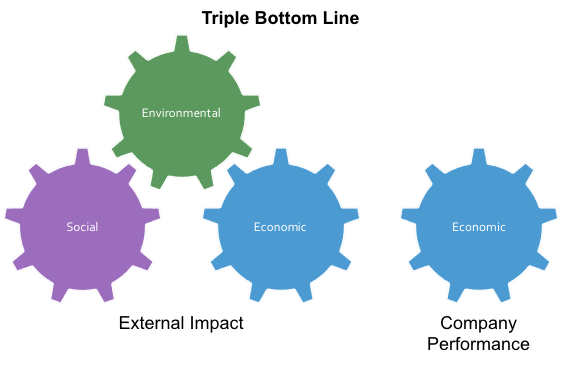

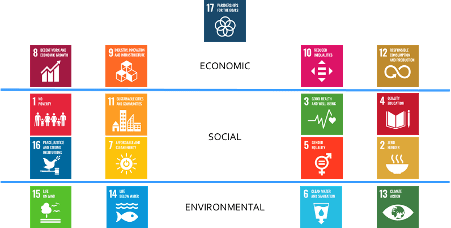

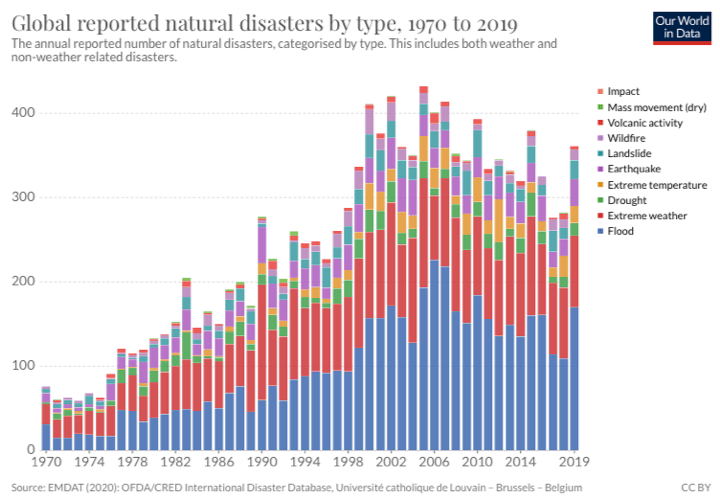

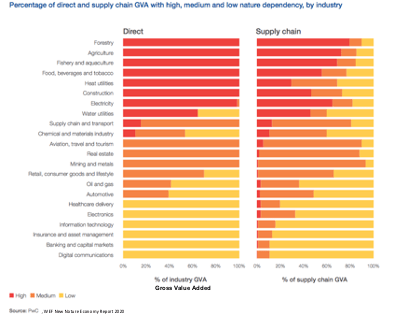

Starting with environmental/climate impact. Through the ESG reporting requirements (Environmental, Social, Governance), companies are being asked to look at the environmental at both level 1 impact, which is the company’s direct impact, and level 3 impact which considers the full supply chain impact including product use. Clearly, at the environmental level the specifics of each sector, and its supply chain, will have different environmental dependencies and different opportunities to create impact. Key sectors such as energy, food, packaging, retail, manufacturing and fashion which have high resource use, significant energy and water usage, and large supply chains will have high environmental impact unless they have already taken action (Figure 15-2). The urgency to create full circular strategies and lead the way is most vital for these high dependency companies; although, that should not stop all companies from moving forward as well.

Taking the view at the societal level, that the climate problem can be solved by just focusing on the major companies that are contributing to climate change, reduced bio-diversity, high water use, etc. is definitely insufficient if you look at the science. Part of the solution is for the public to be also looking at their consumption and making it more in tune with the needs for environmental sustainability. So the full and necessary challenge is to create a major shift in how we all live and how businesses, the government and NGOs operate.

As I noted in Blog 14, for companies delaying this shift to a societally responsible strategy will only result in an increasingly challenging shift for each year of delay as the need to hit targets by certain dates will not shift. Each company in each sector needs to set ambitious and timely targets to make its contribution to this. It is management’s, and the Board’s, challenge to ensure that the strategy they set meets both its economic needs and its responsible level of impact.

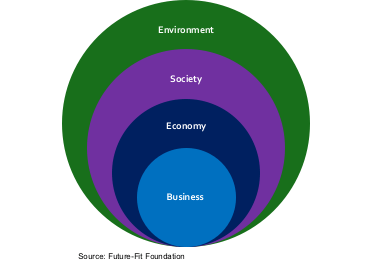

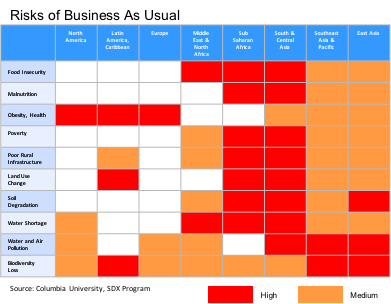

In addition to the sector, the geographic footprint of a business has implications for the impact focus and targets that it sets (Figure 15-3). For example, companies that have large supply chain footprints in the developing world need to be thinking much harder about its specific social impact goals that it wants to achieve. Truly exploring the UN Sustainable Development Goals will help define these. Business as usual in many parts of the world will perpetuate the fundamental environmental, social and economic challenges that need to be overcome.

A helpful approach to thinking about how to incorporate impact programs and goals into the business is to look at the leading companies that are already a long way into this journey to be a responsible company.

One of the companies leading the way is Unilever, who have been focusing on this now for over 10 years. They now report on their progress against their goals each year (Figure 15-4).

Figure 15-4

From their website, you will see that they have created specific time based targets that roll up to overall ambitious goals, they have linked them to the Sustainable Development Goals, they are tracking their performance over time and they are publishing their performance publicly.

Other good examples covering different sectors are IKEA, Patagonia, Interface, Orsted, Tata and Microsoft.

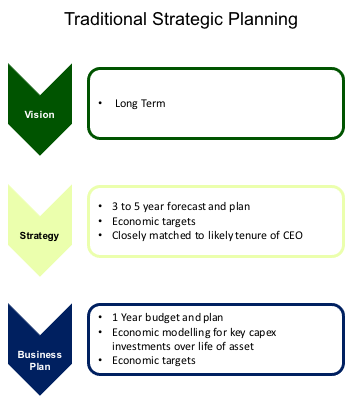

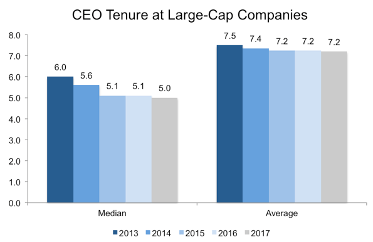

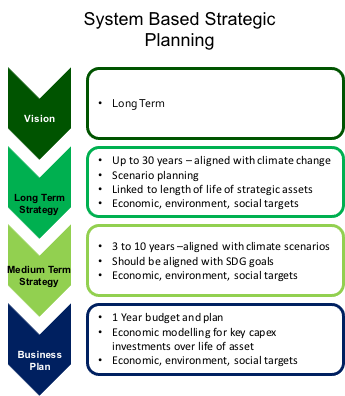

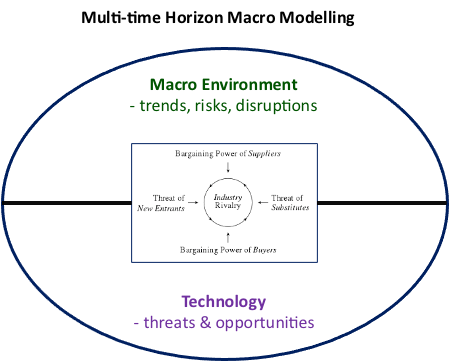

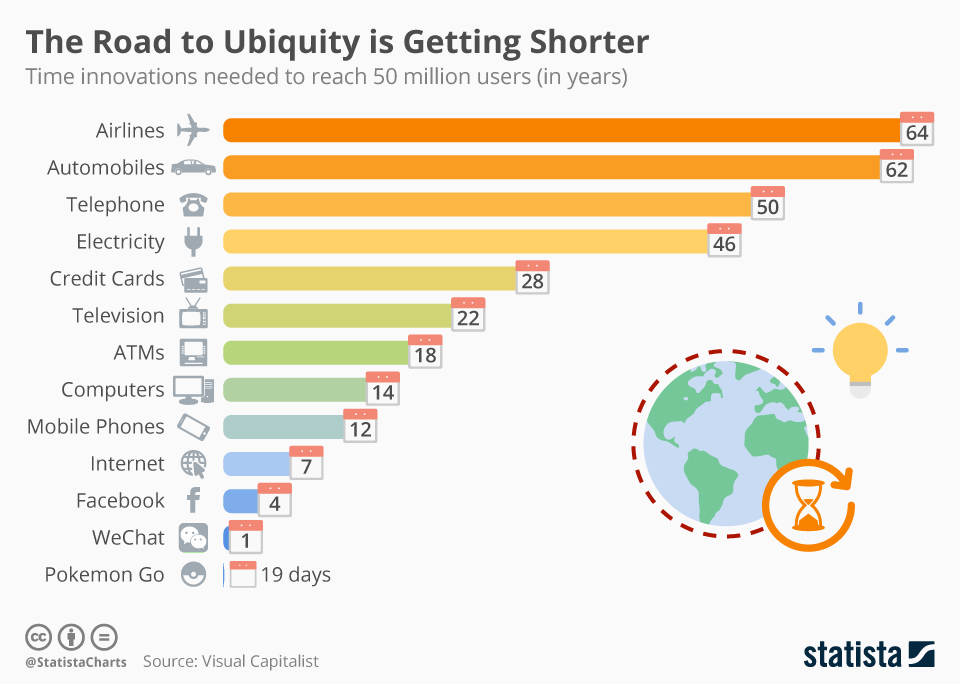

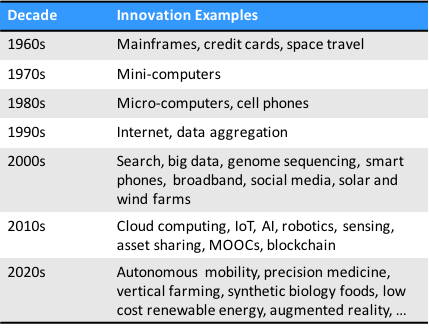

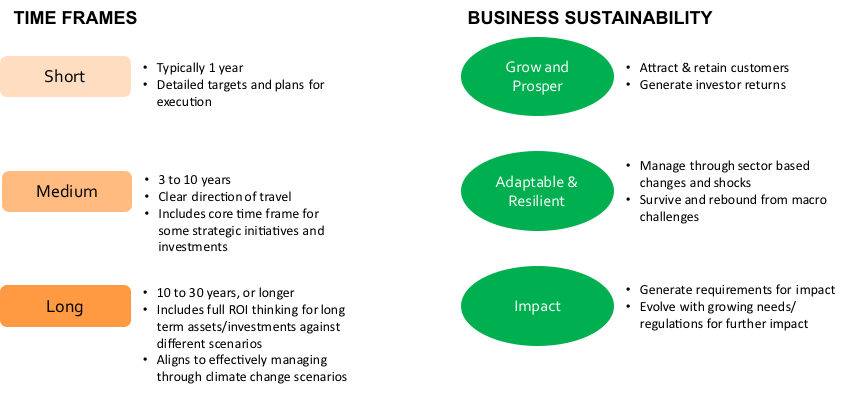

As noted in Blog 12, strategic timeframes need to be extended vs. the typical 3 to 5 year timeframe (Figure 15-5). A longer term time frame needs to be added to consider fundamental impacts such as climate, major changes in technology adoption and putting in place the right components for resilience. 3 to 5 year thinking and short term ROI horizons will not ensure adequate thinking on the sustainability of a strategy.

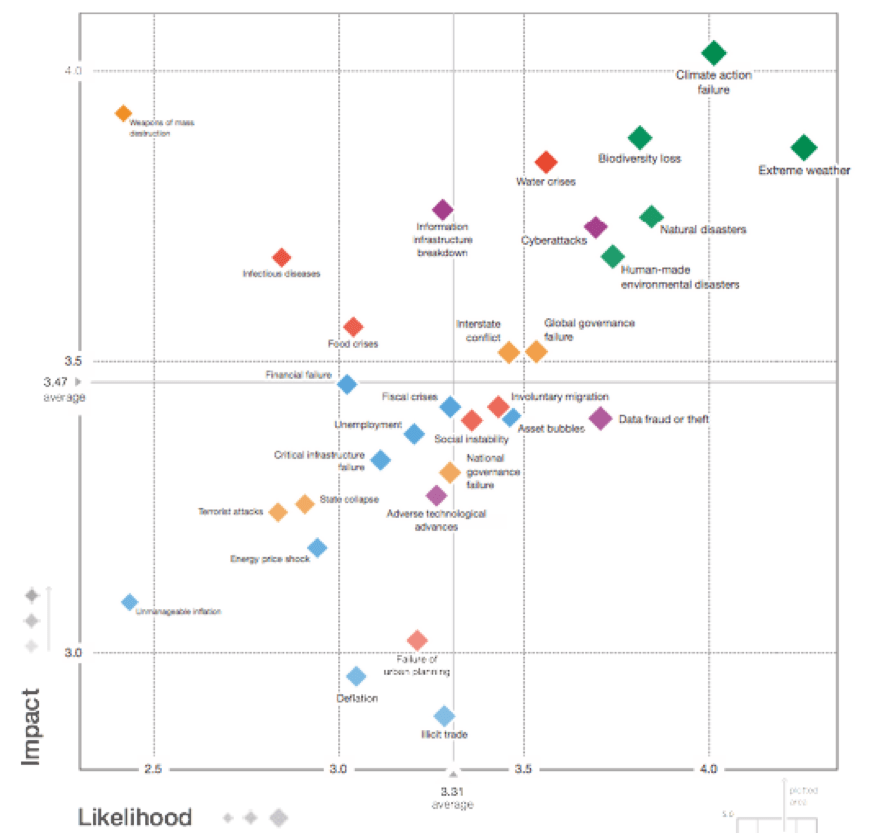

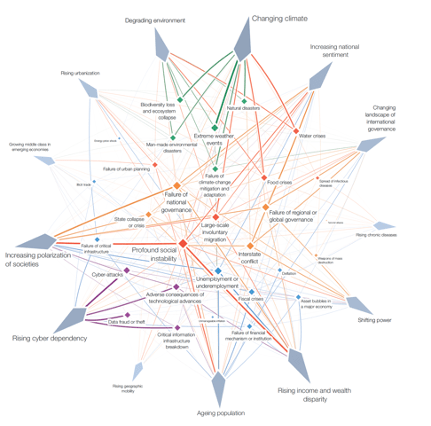

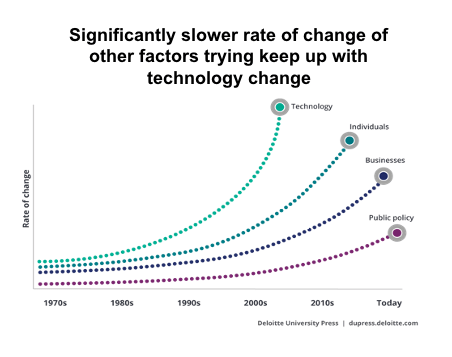

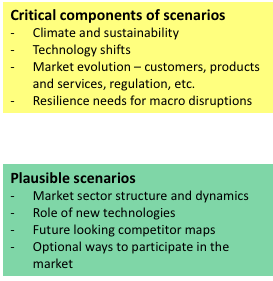

Linked to this, it is critical that there is a proper review of the potential activities and events that change markets and/or generate new opportunities (See Figure 15-6 for examples). These events will range from changing views on environmental responses required, SDG compliance, new regulations, a changing geo-political environment and of course the potential for massive impact from new and converging technologies.

More important than ever is to develop strategic scenarios that would be effective based on different views of what could happen in short, medium and longer term horizons (Figure 15-7). The approach for doing this is to pressure test strategic options against different externalities and come up with some plausible scenarios to evaluate. These scenarios need to be developed holistically and need to be comparable. The components of the scenarios should cover off customers, products/services and supply chains, investment, metrics, people, processes and technology.

With a real analysis of alternative scenarios, the comparison should provide further clarity around the performance opportunities for the business as well as the risk parameters. The true strategic options can be explored along the key dimensions of profitability/ROI, impact, implementation risk, meeting of key stakeholder needs, sustainability and resilience.

This moves strategic thinking significantly on from a pure profit and shareholder only focus. In the short run, realigning the business to survive this pandemic and be able to prosper in the post Covid world, having an organisation that is proactively progressing on gender and race issues, as highlighted by the ‘black lives matter’ and ‘me too’ movements, and making a real contribution to the global climate/environmental targets that need to be met are big topics in most board rooms, and with investors, employees and customers. These challenges need much more than tactical reactions, they are strategic and structural challenges that will inevitably require some major changes to most businesses in terms of how they operate, who they do business with, where they invest, and what performance targets can be expected.

The overall strategy and each of the components should fit coherently into the strategic framework (Figure 15-8). Continuous evaluation of the components of the strategy over time and looking for ways to continuously improve and refine the strategy is equally as vital as the initial setting of the strategy. As the rate of change in the world accelerates, dynamically adjusting/refining the strategy and improving execution is mission critical. Speed and agility are much more important than a singled minded short to medium term focus on efficiency.

The final subject, I want to touch on is the implications of this in a company with a portfolio of businesses. Investors and stakeholders will be looking at the overall economic and impact performance of the business. Non-performing business units within the portfolio will have an overall effect on the attractiveness of the business to investors, employees and other key stakeholders.

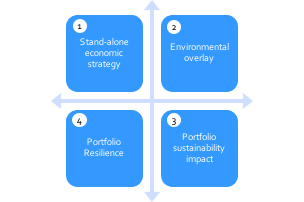

The proposed approach to evaluate a portfolio of businesses is a four step process (Figure 15-9). Firstly, evaluate the portfolio of businesses from an economic perspective. Secondly, overlay the environmental impact of the businesses on to the economic performance of each of the businesses. Thirdly, look at the full alignment of the set of businesses against sustainability impact which will include social and economic impact. Finally, look at the portfolio options from a resilience perspective. This review should be done considering the realistic potential scenarios of each of the businesses.

Now looking at each of these components in a little more depth. Starting with the stand-alone economic strategy, we have the traditional grid looking at business position vs market attractiveness (Figure 15-10). Both components of the strategy should be looked at from a short, medium and longterm perspective. Business position is the combination of profitability, market position, and ability to maintain performance over time as markets change and evolve. Market attractiveness is the combination of size, growth and the economic attractiveness of the market. The grid should be fairly self explanatory. If you have a strong market position in an attractive market then you ideally want to stay in the market and should be willing to invest and grow your position. Whereas, if you have a weak position in an unattractive you would rather manage the business for cash or divest from the market and reinvest the capital in more attractive businesses.

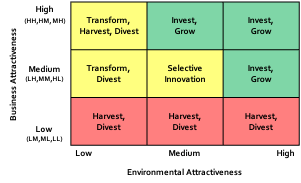

Moving on to the Environmental overlay (Figure 15-11), this takes the overall position from the economic strategy grid in Figure 15-10, Business Attractiveness, and matches it against the Environmental Attractiveness of the business. High environmental attractiveness has a low or positive environmental footprint within the timeframe of meeting the targets set by the Paris Climate Agreement and the environmental focused SDGs. For many businesses, the key target is the year the company will achieve a Net Zero carbon emissions equivalent level 3 footprint (ie. including the full supply chain of the business).

Overall, unattractive businesses, unless you have clear sight on how to transform them, should be harvested and/or sold. If an unattractive business is also very unattractive from an environmental perspective, such as a coal business, it is more likely that this should be divested as attracting investors and raising funds in your overall business will tend to be more challenging. In an equivalent way, if you have a small business with real potential in an environmentally attractive sector it may well be that you should be diverting your investment capacity into this business to build it. An interesting set of companies to watch on these dimensions will be BP, Shell and Exxon. Both BP and Shell have committed to reach a Net Zero CO2 emission target by 2050. It is not yet clear that they have strategies set out on how to achieve this; but, what is clear is that they will be redirecting their cash generation to the renewables sector where they have much smaller strategic positions. It has been a broad set of stakeholder pressures, including collapsing share prices, that have driven the adoption of these strategic commitments.

The third component of a portfolio review is the review of the alignment of impact overall with the business portfolio options (Figure 15-12). Although, climate impact tends to get the lion share of the attention from the press, economic and societal impact are vital components of the SDGs, and in many business and geography combinations, as you can see in Figure 15-3, they may be more important than climate impact. The food sector, including food retailers, are a great example of this with their broad geographically spread supply chains.

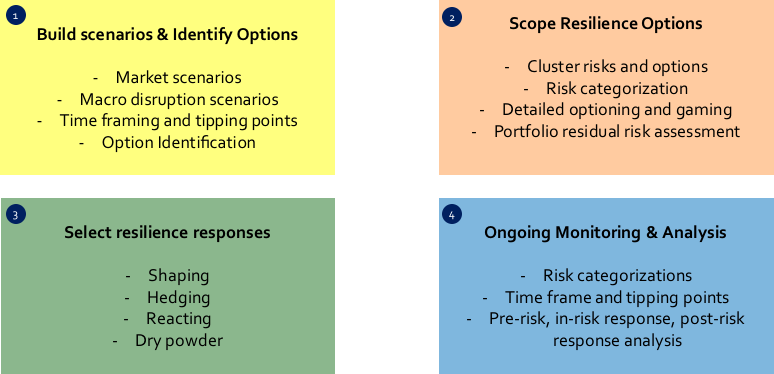

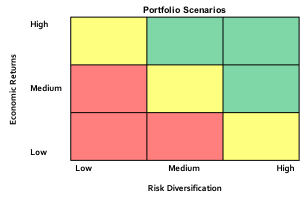

Finally, having evaluated the businesses, and their strategic options, in an overall and comparative context, the final step is to compare realistic combinations of businesses from a portfolio perspective. In particular, given the businesses have been evaluated against the three areas of impact, the portfolio options should be looked at from an economic return vs. a risk diversification perspective (Figure 15-13). The risk assessment is against the longterm sustainability and resilience of the portfolio scenarios. Adjusting a portfolio to reduce risk has real value, as we have seen in this pandemic. The potential benefits of a tight focus of businesses in terms of sector, geography, supply chain, efficiency and commonality of disruption risks may not be justified from a sustainability and resilience perspective. As I have noted before flexibility, adaptability, and diversification can provide real value to the business overall.

This brings to a conclusion, the series on Business Strategy. I hope you have found it thought provoking and useful; and hopefully, it will help you make a difference in your business and create a deeper impact in the world around you.

I will continue to write blogs to delve in deeper to sectors and subjects that will explore strategy and sustainability in a deeper context. As noted in the about section of my blog, REBOOT is not just about business, it is about the need for structural changes, or a new operating system, across all areas connected to our lives and our world.

Please continue to follow, share, engage in conversation, contribute and also reach out to me if you want to talk about this further. I can be reached through LinkedIn.