Blog 6 of the Business Strategy Series

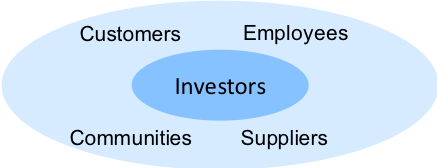

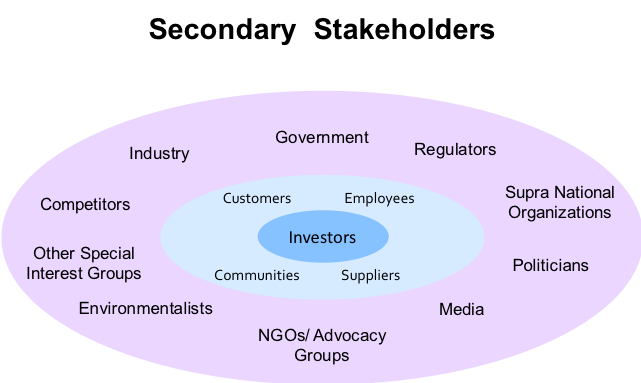

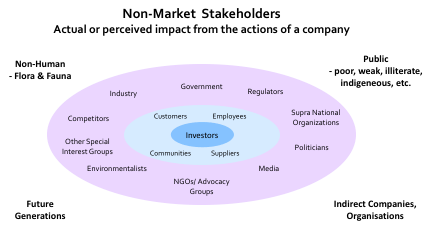

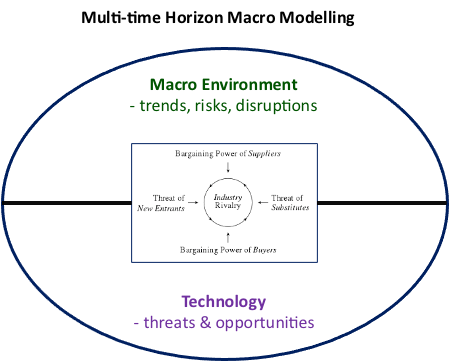

‘From Michael Porter’s Five Forces to macro-models’. In the last blog, we talked about the need to shift from a shareholder perspective to a stakeholder perspective. In this article, I want to cover off the importance of overlaying onto Michael Porter’s 5 forces industry analysis two factors (Figure 6-1). Firstly, an understanding and integration of what is happening in the macro environment into the strategic thinking and planning for a business. In broad terms, these macro factors can be put into one of 5 categories – Economic, Environmental, Geopolitical, Societal and Technological. Secondly, a detailed analysis and assessment of the threats and opportunities that could come from technology.

Both of these factors need to be looked at from a multi-time horizon perspective. The external dynamics impacting a company can be significant on all these horizons; therefore, scenario modelling on each of these horizons is essential. As examples, in the short term, we are seeing how a pandemic can have dramatic effects on our business. In the medium term, the movement of a technology into a growth phase of rapid adoption could have a signficant effect on a competitive environment and customer purchasing dynamics. In the longer term, climate change is affecting most businesses and sectors, and may affect longer term investment decisions. Superior understanding about how an industry could be affected provides a real opportunity to outperform and improve business sustainability.

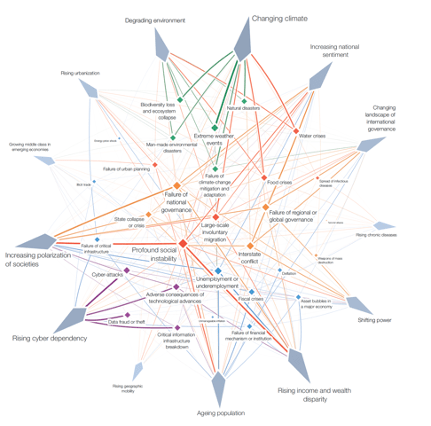

Starting with the macro environment, the World Economic Forum ‘Risk Trends Interconnection Map’ (Figure 6-2) illustrates well the range of macro factors that a business may need to watch and monitor. This will help a business decide how to adjust its strategy as these factors and their interconnections wax and wane over time.

Just since February 2020 and the emergence of Covid 19, businesses are having to deal with a combination of many factors including the need for remote working, limited ability to make sales, massive financial pressures from the financial crisis, a collapsing oil price, increasing trade tensions between the US and China, increasing national sentiment, potential implications of greater control being put on Hong Kong by the Chinese government, and in some sectors a heightened level of cyber attacks. Do any of these have any bearings on your strategy going forward? This level of challenge to a business will not go away and for many the issue of climate change will only create even more profound challenges. Thinking about these potential risks in different scenarios over the short, medium and long term is vital. The key is really to solve how to take advantage of the situation to strengthen the performance potential of the business and strengthen its competitive position.

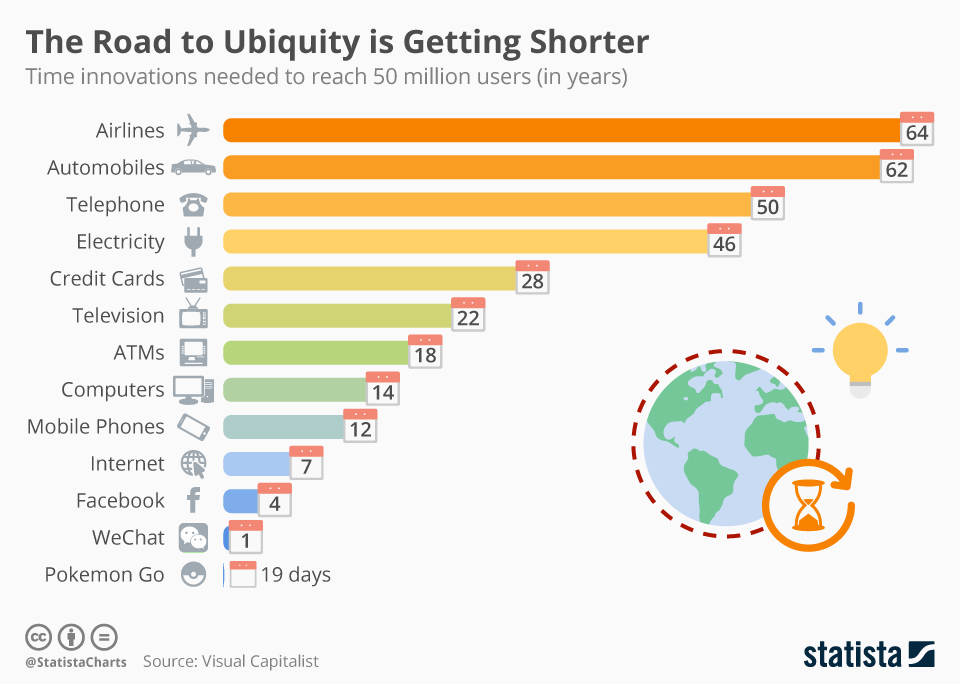

Secondly, it is vital to look at the threats and opportunities of technological change. It is easy to forget the accelerating speed at which new technology is adopted at scale (Figure 6-3). For businesses, it affects what products and services can be provided, how businesses operate, which markets they can reach and focus on; and, it results in whole new market sectors being developed.

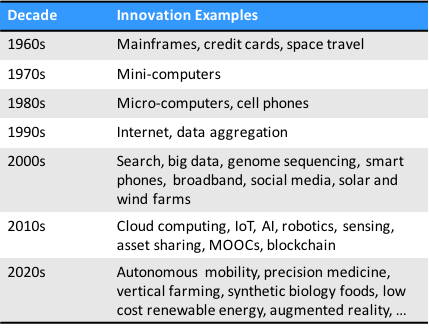

In addition, the speed at which new technologies are being developed and related products are being introduced is astonishing (Figure 6-4, 6-5). In the research world, there are unprecedented levels of information sharing and collaboration coupled with increasing speeds of access to new research through digitization, open access and data sharing. Over time, the profile of research is showing higher levels of collaboration and higher levels of cross border research cooperation. As long as the world keeps opening up this will only accelerate; and in turn, continue the acceleration in the development of new technologies.

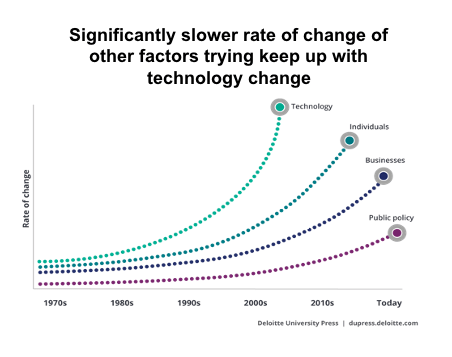

The biggest challenge emerging from new technology being adopted to its full potential is the ability of individuals, businesses and governments to understand its potential and reap the full benefits (see illustrations in Figure 6-6, 6-7). Increasingly we are also going to find that many high value applications involve the convergence and integration of multiple technologies. For example, an autonomous driving vehicle combines the use of recent and emerging technologies including AI, robotics, battery storage, big data and sensing.

Businesses need to be more focused than ever on understanding technology based opportunities and innovating new products and services. The old fashioned approach of driving leadership from focusing on primarily driving down its cost position or innovating within its existing knowledge and parameters will not survive.

In the analysis of the potential impact of technology, a key factor to assess is the speed of adoption of new technologies. Despite the potential for high speed adoption, this is not always the case. It is particularly important to analyse in sectors where there is a high concentration of market share among a few companies. In these situations, there are two factors that affect the speed of change. Firstly, for any of the key competitors is there a bigger profit opportunity in the short or medium term of adopting new technology? If the business model of these competitors could be disrupted and their could be a leak of profitability then, depending on the level of competitor concentration, the adoption could be slowed significantly. Secondly, once one of the big players makes an aggressive move to shift to adopt new technologies and adjust their business model, perhaps from shifting to a long term view of how they need to compete, then the rate of change in the industry is likely to change.

This slowing down of the potential rate of adoption, was very prevalent in the research publishing sector with the likes of Reed Elsevier (now RELX plc) and Springer (now Springer Nature). The rate of adoption of the real potential of digital technologies and its full implications to benefit the sector probably took at least 10 years longer than it could have. Time bought them the ability to search for new sources of profitability before any core compression of performance in their core business. It would also be interesting to speculate what the energy sector would look like today if one of Shell, BP or ExxonMobil would have made a strategic commitment to commit to clean(er) energies say 15 years ago; after all, they knew about global warming in the 1980’s.

Overlaying onto an industry analysis, how to take advantage of an increasing rate of technology introduction, understanding factors that may delay technology adoption, and managing continuously changing dynamics surrounding a market is fundamental to strengthening the performance potential and competitive postion of a business.

In the next blog, we will look at shifting from risk monitoring to business resilience.